Brazil, a country that produces 42% of the world’s soybeans and 12% of its corn, is critical to global food supplies, but that production hinges on the ability to import billions of dollars’ worth of fertilizer from thousands of miles away. Matt Simpson, CEO of the company Brazil Potash, wants to ensure Brazil has more reliable fertilizer supplies closer to home.

Brazil — the largest producer of soybeans in the world — is also the largest global importer of fertilizer, buying $16 billion worth of it in 2021 from countries like Russia, Belarus, Morocco, and the U.S., according to the data company Observatory of Economic Complexity.

About 12.6 million metric tons of those imports are potash, an amount that is growing every year, Simpson tells Agri-Pulse. His company, a subsidiary of the Toronto-based investment bank Forbes & Manhattan, can reduce that dependence by producing about 2.2 million tons and selling it to nearby Brazilian farmers.

The company’s output from a $2.5 billion facility “will initially be about 18% of Brazil's consumption,” he said in an interview. “However, we have the ability over time to double or triple the output of this mine. So, we'll probably never be able to make Brazil self-sufficient on potash, but we can easily get up to at least half of Brazil's need, if not more in time.”

Matt Simpson, Brazil Potash

Matt Simpson, Brazil PotashSimpson said Brazil is “exposed massively” because of its reliance on imported fertilizer. “Brazil is the second largest, fastest growing consumer of potash in the world, but imports 98% of its need, almost half of which comes from Russia and Belarus.”

To protect Brazil’s status as an agricultural powerhouse, it needs to produce domestically a lot more of the fertilizer that it consumes, he said. Brazil Potash could begin breaking ground on its mining and processing facility in the small town of Autazes in the Brazilian state of Amazonas early next year. The company, run by Simpson from his Toronto office, has completed all 78 of Brazil’s permitting requirements and the government has approved 76 so far.

That has Simpson optimistic that the company — its operating name in Brazil is Potassio do Brasil — can begin producing potash and shipping it to farmers in Mato Grosso, the largest soybean-producing state in the world’s largest soybean producing nation, by 2028.

“We've done all the drilling and all the engineering studies to confirm that not only is it there, but that it processes to that 95% pure pink product that the farmers are used to buying,” he said.

Here’s how it will work: The new facility in Autazes, population 40,000, will sink shafts about 2,800 feet deep to bring up sylvinite. The company will convert that into potassium chloride and truck it about six miles to barges on the Madeira River.

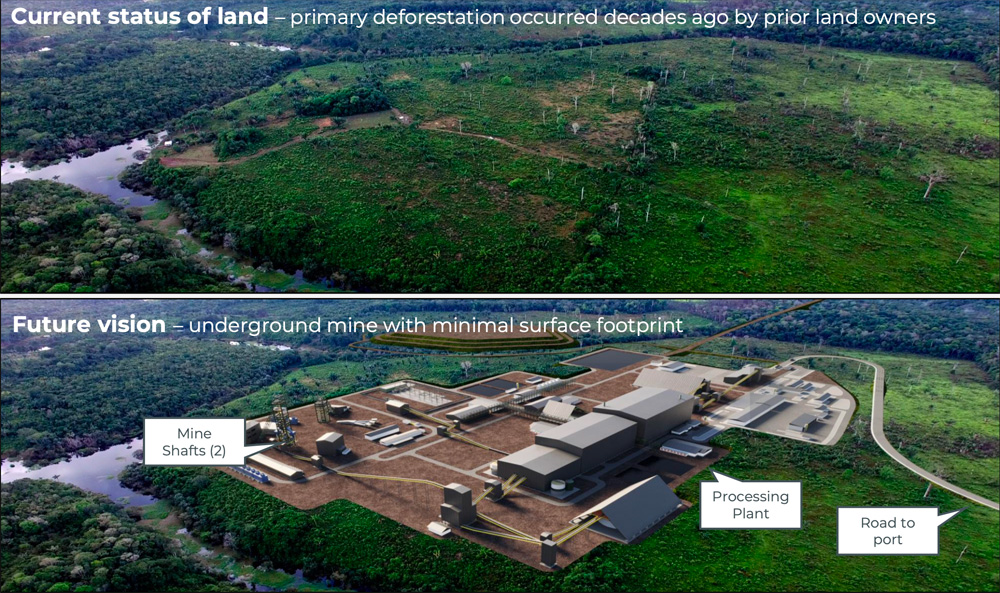

Despite the fact that the mining and processing facility will be located in the state of Amazonas, home to much of the environmentally sensitive Amazon rainforest, none of it will be affected by Brazil Potash, Simpson said.

“The land where the project is going to be located was largely deforested many decades ago by private owners and right now it's largely cattle farmland,” he said. “The surface footprint of the mine is quite small. There's no primary rainforest impacted by this project. You can see the occasional sporadic tree on the land but … those are all secondary growth.”

Brazil Potash has deals in place to supply some of the biggest farming operations in the state of Mato Grosso, including the massive Amaggi conglomerate. That operation farms 362,000 hectares (nearly 900,000 acres), produces 1.2 million tons of soybeans, corn and cotton, and manages road, rail and waterway transportation, warehouses, terminals and ports, soy crushing plants and a fertilizer mixing facility.

It’s easy to be “in the know” about what’s happening in Washington, D.C. Sign up for a FREE month of Agri-Pulse news! Simply click here.

Brazil Potash even has a river transportation arrangement with Amaggi, which has a fleet of 212 barges. Amaggi ships its crops via truck and barge to northern ports. There are seed and other goods for the backhaul, but there’s also room for potash, said Simpson.

“And when you think about what's going on in the world today, you've got countries at war and countries that are sanctioned … controlling half of the world's potash,” Simpson said. “So that's a pretty, pretty scary thought. Developing this project helps contribute to global food security, because we're going to be right in the backyard of the Brazilian farmer.”

Current status (top) and digital rendering (bottom) Autazes potash mine.

Current status (top) and digital rendering (bottom) Autazes potash mine.Farmers in Mato Grosso harvested about 44 million metric tons of soybeans for the 2022-23 marketing year, according to data from the state government. Brazil produced 158 million tons of soybeans overall. The state is suffering heat waves now and some farmers are being forced to replant because of damage to the plants, but the state and country are still expected to see bumper crops for 2023-24.

The U.S.-based Mosaic Inc. is investing in domestic potash and phosphate production as well as blending and distribution facilities, but imports will be the main competitor for Brazil Potash, and they won’t come close to matching the Canadian company when it comes to price, said Simpson.

Brazil Potash will make it “very, very disruptive to do trade because no one can get even close to our cost level, delivered to a farmer in Brazil. Our cost to extract, process and transport the potash to a Brazilian farmer is less than the transportation cost for everybody else in the world. … There's nothing special about how we're processing it. What's special is that we're in the backyard of the farmer and everyone else is 9,000 to 12,000 miles away.”

For more news, go to Agri-Pulse.com.