The ethanol industry and its political supporters are pushing the Biden Administration to put more pressure on Brazil to relax tariffs that have depressed exports of biofuel to the country.

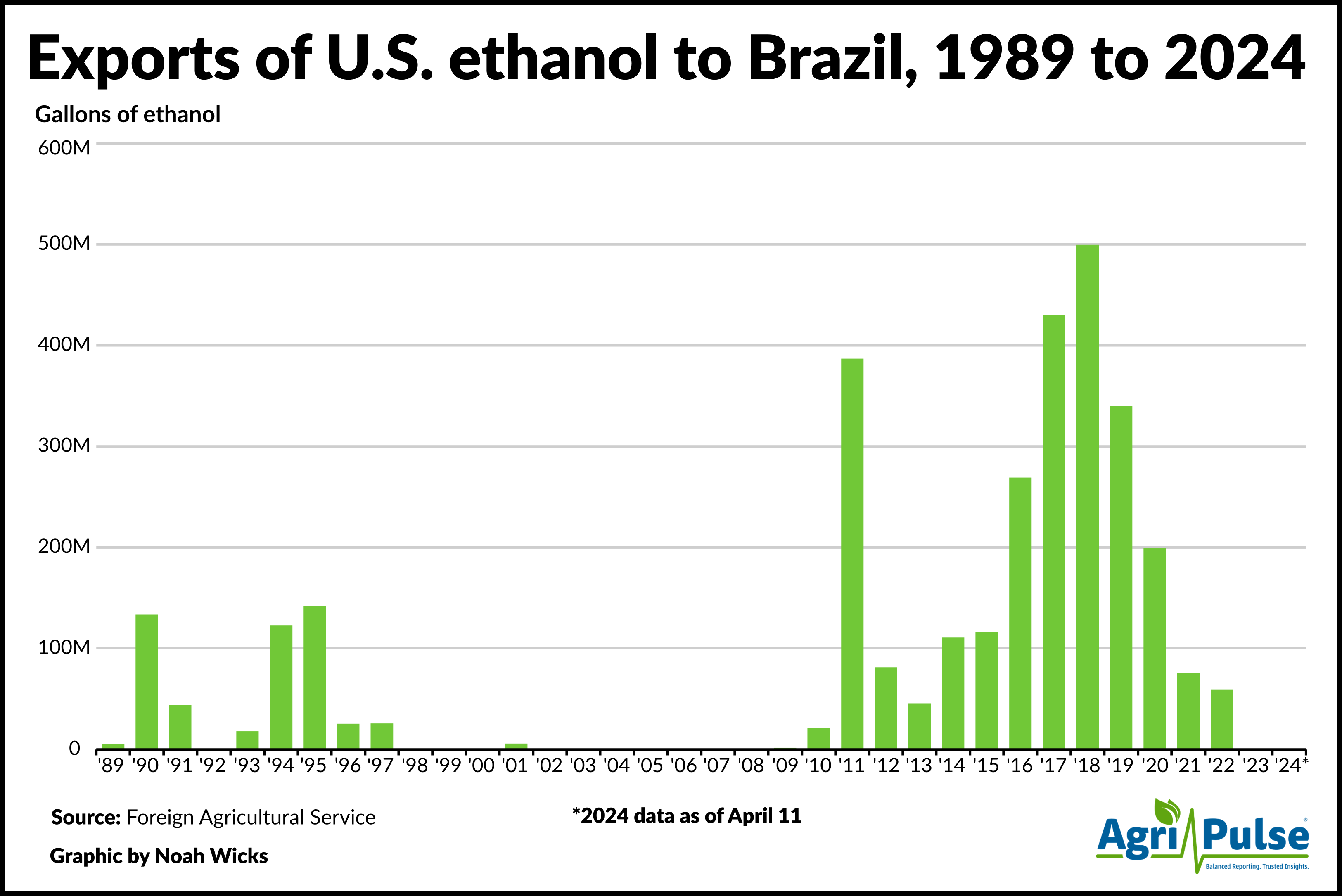

Sales of U.S. ethanol to Brazil were virtually duty free between 2011 and 2017, according to the Office of the U.S. Trade Representative’s 2024 report on barriers to U.S. trade.

However, between 2017 and January 2022, Brazil imposed a tariff-rate quota and later a 20% Mercosur common external tariff on ethanol imports. The tariff was suspended in March 2022 but reimposed last January at 16%. It currently stands at 18%, according to USTR.

“It certainly is a sore spot for the U.S. ethanol industry, the kind of breakdown of that trading relationship with Brazil,” said Ed Hubbard, Renewable Fuels Association (RFA) vice president and general counsel. Before the tariffs, Brazil was at times a “top three” market for U.S. ethanol, he told Agri-Pulse.

U.S. ethanol exports to Brazil peaked at 499.6 million gallons in 2018 but have since plummeted, according to USDA’s Foreign Agricultural Service. The U.S. exported 59.4 million gallons in 2022 and that number dropped precipitously — to 29,779 gallons — in 2023. Since January of this year, FAS data through last Thursday shows 4,835 gallons of U.S. ethanol sold to Brazil.

Brazilian trade group ABICOM, which represents fuel importers, submitted a formal request to drop ethanol duties last October, according to a press release from RFA. The U.S. Grains Council, Growth Energy and RFA followed the request with a set of comments last week threatening to advocate for “restrictive measures to entry of Brazilian ethanol into the U.S.” if Brazil continues its tariff policies. Should the tariffs continue, they also said they would not work with Brazil on efforts to expand ethanol for other uses, such as Sustainable Aviation Fuel.

“We strongly consider the permanent reinstatement of the duty-free access for ethanol as a window of opportunity to strengthen the bilateral agenda and stimulate trade cooperation between Brazil and the United States,” they wrote.

Bloomberg reported last week that Brazilian Agriculture Minister Carlos Fávaro told attendees of a sugar cane conference that Brazil would maintain its tariffs on U.S. ethanol imports to avoid “making things more precarious for Brazilian producers.”

U.S. lawmakers have also called for action. Twenty House members sent two letters to Biden Administration officials last month about biofuel trade barriers, both of which mentioned the Brazilian ethanol tariffs. In one of the letters, the lawmakers said the Renewable Fuel Standard and 40B Sustainable Aviation Fuel tax credit incentivize Brazilian ethanol imports to the U.S., but “this treatment is not reciprocated for American corn ethanol in Brazil.”

“I think there has to be action by the administration on this,” Rep. Darin LaHood, Illinois Republican member of the House Ways and Means Committee, told Agri-Pulse. “We bend over backwards in this country to have free markets and work well with countries, but the approach that the Brazilians have taken has really been discriminatory.”

Doug McKalip, lead agricultural negotiator at the Office of the U.S. Trade Representative, told Agri-Pulse in an interview last week that reducing the Brazilian tariff is a “big priority” for USTR. He added that the U.S. does not currently have a tariff on Brazilian ethanol.

“It’s really an imbalanced arrangement right now and one that’s unjustifiable, so we’re going to continue to engage with Brazil and get that resolved,” McKalip said.

It’s easy to be “in the know” about what’s happening in Washington, D.C. Sign up for a FREE month of Agri-Pulse news! Simply click here.

McKalip did not provide a time frame for addressing the Brazilian tariff, but said he hopes a resolution will come “in the very near future.”

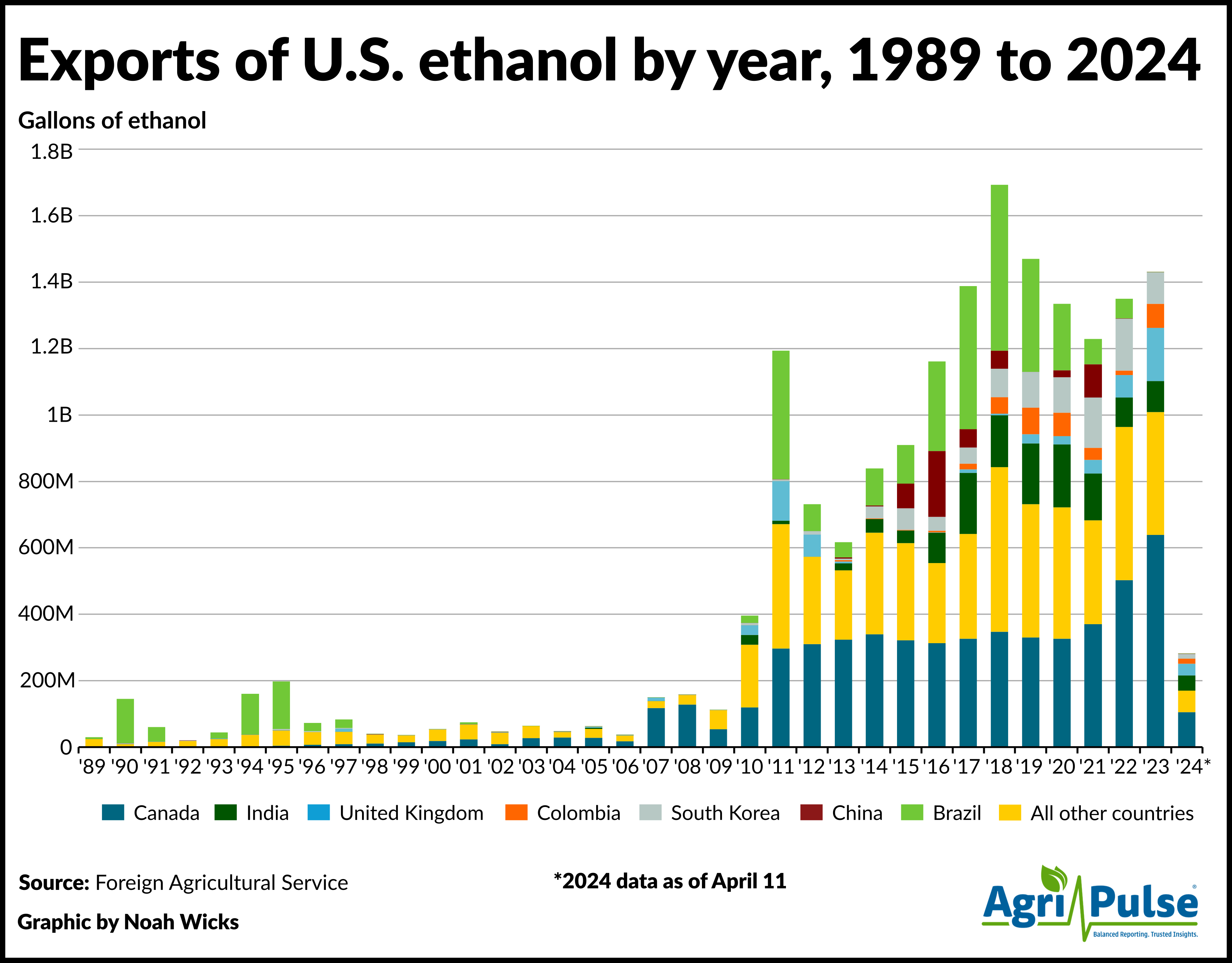

While Brazil’s tariffs are one major barrier to U.S. ethanol, challenges exist in other countries as well. India, for example, currently bans imports of fuel-grade ethanol, despite allowing it for industrial use. The U.S. sold 92.6 million gallons to the Asian nation last year, according to FAS.

India is currently blending 10% ethanol in gasoline, but has committed to making E20 available by 2025, according to the International Energy Agency. RFA's Hubbard said India will “not make it far” on this goal without allowing ethanol imports for fuel use.

“The only option, if you do not open the door to imports, is to backpedal on your blending commitments,” Hubbard said.

The European Union also maintains some ethanol trade barriers, Hubbard said, with crop-based biofuel limitations in aviation and maritime fuel regulations. The House lawmakers' letter also mentioned the United Kingdom, which has “applied a cap on crop-based biofuels that begins in 2027 and becomes increasingly restrictive over the next five years.”

Other obstacles, according to the USTR report, include Thailand's restrictions on biofuels intended for fuel use, Vietnamese tariffs of 10% on ethanol, and taxes in the Dominican Republic on imported ethanol. The report also suggests Japan should increase blending rates to at least 3% to expand U.S. export opportunities for that market.

The United States last year exported a total of 1.4 billion gallons of ethanol, according to the FAS data. The largest amount — 638 million gallons — was to Canada. The United Kingdom imported 160 million gallons, the Netherlands 112.2 million gallons and South Korea 94.5 million gallons.

The United States last year exported a total of 1.4 billion gallons of ethanol, according to the FAS data. The largest amount — 638 million gallons — was to Canada. The United Kingdom imported 160 million gallons, the Netherlands 112.2 million gallons and South Korea 94.5 million gallons.

Canada’s appetite for renewable fuels is likely driven to some degree by its Clean Fuel Regulations, which share some similarities with California's Low Carbon Fuel Standard. U.S. ethanol imports to its northerly neighbor jumped from 370.2 million gallons in 2021 to 502.5 million in 2022 when its regulations were finalized.

For more news, g to www.Agri-Pulse.com.