WASHINGTON, Mar. 22, 2017 - U.S. imports of biomass-based diesel, which include biodiesel and renewable diesel, increased by 65 percent in 2016 to reach a record level of 916 million gallons, according to a new report by the U.S. Energy Information Administration.

Increasing Renewable Fuel Standard (RFS) targets and the recently expired biodiesel blender’s tax credit were strong drivers of biomass-based diesel demand in 2016, incentivizing increased levels of imports of both biodiesel and renewable diesel. The biodiesel blender’s tax credit has expired several times in the past, most recently expiring at the end of 2014, only to be retroactively reinstated.

Biodiesel leaders were in Washington earlier this month to advocate to discuss reforming the biodiesel tax incentive as a domestic production credit, which they say would open the door for the industry to support an impressive 81,600 U.S. jobs and $14.7 billion in total economic benefit.

Under the current blenders structure of the incentive, foreign fuel imported and blended with petroleum diesel in the U.S. is eligible for the tax incentive.

EIA says that biodiesel and renewable diesel are valuable because they qualify for the two major renewable fuel programs in the United States: the nationwide RFS and California’s Low Carbon Fuel Standard (LCFS). Biomass-based diesel fuels have additional advantages over other renewable fuels such as fuel ethanol because of their relatively high energy content and low carbon intensity, which allow them to qualify for higher credit values in both renewable fuel programs.

Both biodiesel and renewable diesel fuels are produced from refining vegetable oils or animal fats. Biodiesel is blended with petroleum diesel up to 5% or 20% by volume (referred to as B5 and B20, respectively). Renewable diesel is a drop-in fuel—meaning that it meets specifications for use in existing infrastructure and diesel engines—and is not subject to any blending limitations.

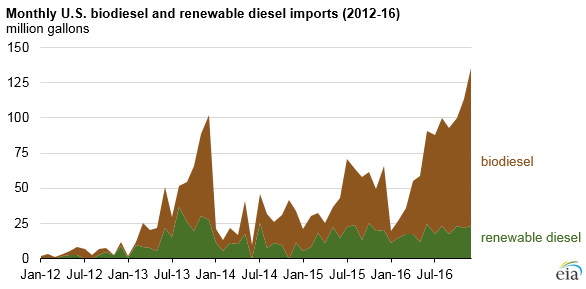

U.S. imports of biodiesel, which totaled 353 million gallons in 2015, nearly doubled in 2016 to reach a record-high 693 million gallons. More than half of U.S. imports of biodiesel originated from Argentina (64%), with much of the rest coming from Indonesia (15%) and Canada (14%). Roughly half (53%) of biodiesel imports arrived along the Atlantic Coast because of the favorable economics of importing seaborne cargoes to that region relative to the movement of domestically produced product by rail from the Midwest. On a monthly basis, biodiesel imports exceeded 100 million gallons for the first time in December 2016. The five largest volumes for monthly biodiesel imports occurred during the second half of 2016, ahead of the expiration of the $1/gallon biodiesel blender’s tax credit.

Learn about the benefits of subscribing to Agri-Pulse. Sign up for your four-week free trial Agri-Pulse subscription.

Imports of renewable diesel increased 9% from 2015 levels to reach 223 million gallons in 2016. Similar to 2015, Singapore was the only source of imported renewable diesel, which was primarily destined for the West Coast, most likely for compliance with California's LCFS program. Given the way lifecycle greenhouse gas emissions are calculated for compliance in California’s LFCS, renewable diesel is one of the most valuable renewable fuels for generating LCFS credits, which has encouraged its import into the region in recent years.

EIA’s most recent Short-Term Energy Outlook projects biomass-based diesel imports to remain largely flat in 2017 because of the expiration of the blender’s tax credit, before increasing in 2018 as a result of increasing RFS targets. Net imports of biomass-based diesel (imports minus exports) are expected to remain largely unchanged at roughly 800 million gallons in 2017, accounting for approximately one-third of total U.S. biomass-based diesel consumption in 2007, before increasing to around 900 million gallons in 2018.

#30