WASHINGTON, Sept. 13, 2017 – Call it market equilibrium or stability. Call it nap time in the Heartland’s farmland market.

But across the Corn Belt, the Great Lake States and Northern Plains, the land market is surely not the torrid trading pit it was just a few years ago. The average price of Iowa cropland, for example, almost doubled in just four years, to a peak of $8,750 per acre in 2014.

Instead, most players on both sides of those regional land markets have backed off, farm real estate experts say.

For starters, said Randy Dickhut, senior vice president of Omaha-based Farmers National Company, “in most years, less than 1 percent of farmland in the U.S. is sold in the open market. Very little changes hands in any given year,” he says, adding that competitive sales probably are running well under 1 percent currently.

Randy Dickhut

After the brisk cropland market of a few years ago, prices in the Heartland have flattened, and have most often receded, so “there is not a lot on the market for sale,” Dickhut says.

“The supply is down, but demand is down a little,” he said, “so we are in an equilibrium.” He says the desire for cropland has receded largely “because farmers and ranchers, who are the predominant buyers, are being more cautious. There are a few less of them in the market.”

But most other types of buyers, whether non-farm individuals, real estate investment companies, or foreign investors, have also stepped back, Dickhut says.

Why? “The return on investment – that ROI – has definitely declined along with interest rates over the last number of years,” he says. (When savings interest rates are low, as now, many farmland investors are ready to accept lower returns on land, he points out.) Further, he says, disappointing cash returns on Midwest cropland are “keeping some individual investors from being very aggressive in buying cropland.”

Troy R. Louwagie, land market expert and broker for Hertz Real Estate Services in Mount Vernon, Iowa, explains how the ROI has wilted. “For about 100 years, Iowa land has appreciated 3 to 4 percent a year, on the average. Plus, landlords have typically gotten 3 to 4 percent return on the asset (from rent) annually,” he says. So, the landowner could expect 6 to 8 percent total annual return in the long run.

But, instead, land values aren’t increasing now, and stingy field crop prices are eroding cash rents, so the total return on Midwest farmland has plunged, he says.

Note, too, that laws in nine states across the western Corn Belt and Northern Plains try, to varying degrees, to restrict corporations, out-of-state and foreign interests from owning agricultural land. Those laws are, however, riddled with exemptions for family farming corporations, livestock operations, and more. In fact, Nebraska’s anti-corporation farming law has been left unenforceable since a federal appeals court ruled in 2007 that it violates the U.S. Constitution’s “dormant Commerce Clause,” relating to free trade between the states.

Rusty Rumley, attorney with the National Agricultural Law Center at the University of Arkansas, says that state anti-corporation farming laws, in general, “are really geared toward out-of-state corporate ownership.”

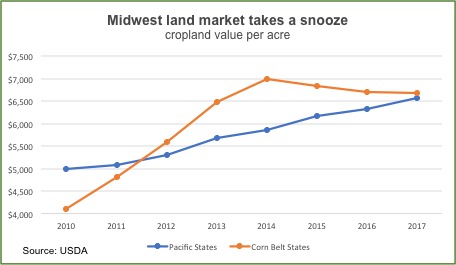

The price of farmland, Dickhut says, “varies by region how much it has come off the peak,” and it has steadily increased in some regions. If fact, while cropland values in the Corn Belt and Plains have slipped since 2014, they have remained steady in some other regions and have climbed steadily since the 2009 recession in the Pacific Coast, Southern Plains and Southeast regions, USDA surveys show.

For example, says Dickhut: “There is more interest in (farmland investment in) the permanent planting areas of the Pacific Northwest and California, and there is definitely more foreign interest there. It’s a different land market there than here in the Midwest… because of the expansion of vineyards, nut crops, orchards… (and) proximity to exports markets to Asia. Just a whole bunch of reasons.”

Also, he says, while ag land in the Heartland is still priced mostly for its agricultural production potential, other factors, such as commercial or other development, and recreational or lifestyle values often take priority in the land values in other regions.

Indeed, most states don’t restrict foreigners from buying agricultural land, and such purchases, including 146,000 farmland acres by China-based Shuanghui when it acquired Smithfield Foods in 2013, are no longer rare.

In fact, USDA’s record of foreign purchases of America’s agricultural land, as recently analyzed by the Midwest Center for Investigative Reporting, found that foreign owned farmland acreage nationwide nearly doubled from 2004 to 2014. The 2014 total, 27 million acres, represents 3 percent of about 910 million total acres of U.S. farmland.

Meanwhile, in the Midwest, Dickhut says, “prices for good quality cropland haven’t declined as much as people may have thought. It’s kind of in a holding spell.”

And while Louwagie reports some of eastern Iowa’s top quality land prices have dropped “about 20-25 percent off the peak,” he notes that, “in an investor’s eyes, when an asset corrects 20 to 25 percent, maybe it’s time to jump into (the market).”

Michael Downey, an associate of Louwagie and a farm manager with the Hertz firm, agrees that the land market pace may pick up. “The overall land market has remained surprisingly stable,” he said. In part, “that is because there are relatively few properties for sale.”

Still, he says, “there are folks out there looking,” including investor groups, he says. And, “there are signs of more farms coming on the market later this fall, probably after harvest. It will be interesting to see what kind of bearing that may have land price trends, if any.”

#30

For more news, go to: www.Agri-Pulse.com