Farmers who’ve long pined for a single policy that offers strong coverage for all of their crops and livestock – at an affordable premium – are finally getting their wish.

Crop insurers began offering USDA-backed Whole Farm Revenue Protection (WFRP), as mandated by the 2014 farm bill, in 2015. They sold 1,126 policies – nearly all to farmers in the Pacific Northwest and California – ensuring $1.15 billion in those policy holders’ annual revenue. Sign-ups for 2017 were more than twice that: 2,790 policies, covering $2.9 billion in revenue. What’s more, farmers coast-to-coast had bought WFRP as more agents became versed in its details. Despite the growth, WFRP policies are still just a small portion of the crop insurance policies sold - less than 0.2 percent of last year's 1.5 million revenue protection policies, for example.

"This is really starting to take off,” declared Dave Paul, a top expert on the new coverage, during a WFRP orientation session at the National Farmers Union convention in Kansas City, Mo.

Dave Paul

Paul spent 21 years with USDA’s Risk Management Agency (RMA). He helped develop both of WFRP’s parent programs, “Adjusted Gross Revenue and AGR-lite,” which was less attractive coverage that had a limited crowd of takers in the Pacific Northwest, where Paul was stationed with RMA and Pennsylvania. Paul is now vice president for underwriting for NAU Country Insurance Company, which is focused on marketing WFRP and further improving the product.

Ferd Hoefner, senior adviser to the National Sustainable Agriculture Coalition, says the group has pushed USDA and insurers for decades to develop an attractive policy covering all of a diversified producer’s crops and livestock.

WFRP “was an attempt to get a better product out there, and I think we essentially got it,” Hoefner suggests. He especially likes the “bonus for diversifying. Our very diversified farmer members need a product like this. But we also love it because we want more farmers to consider diversification as a way toward better environmental protection,” he said.

Here are some farmer-friendly high points about WFRP:

- All commodities in all 50 states are eligible. “RMA has a complete list of commodities in all counties,” Paul notes.

- Farmer premiums are subsidized at 80 percent for buy-up coverage on up to 75 percent of crop value if at least two crops are insured. That compares with a 55 percent subsidy with basic single-crop policies and an average of 62 percent for all USDA-backed crop

insurance.

insurance. - Beyond the 80 percent subsidy, farmers can get further “diversification discounts” for up to seven crops and livestock.

- Prevented-planting coverage in WFRP is not diminished in a subsequent year because of a prevented-planting claim in the year before.

- “This is as good a prevented-plant coverage as you can get,” Paul says, plus “we don’t have another policy that covers livestock like this does” as long as crops are insured, too.

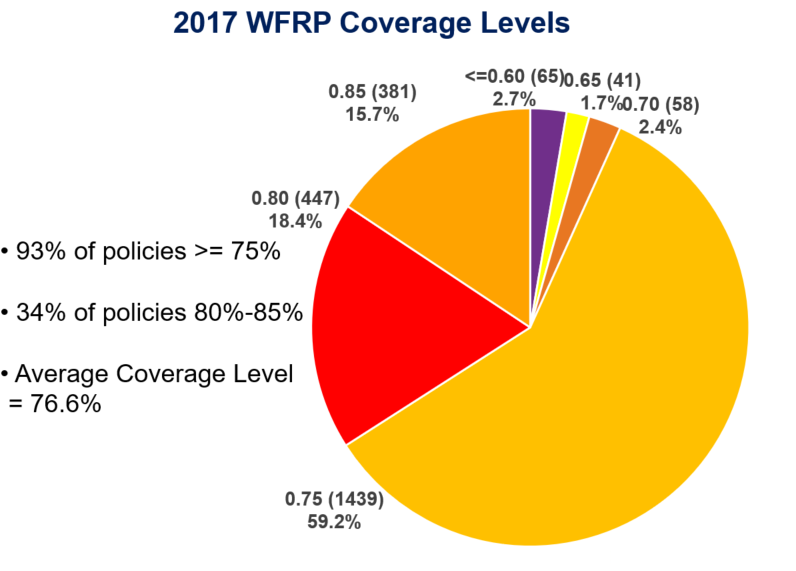

Farmers are taking advantage of the high subsidy levels available. For example, Paul reports, 93 percent of WFRP 2017 policies were to cover at least 75 percent of total average farm revenue. (See chart from NAU Country Insurance Company.)

Paul also points out some WFRP limitations:

- Coverage can’t exceed $1 million for either livestock or plant nurseries and greenhouses within the WFRP policy.

- RMA integrated the IRS F Schedule (farm) into the implementation. Farmers must have five years of their F Schedule data to enroll. They can prepare claims at the end of their production season, but can’t claim an indemnity until after they’ve filed the income taxes for the year.

- “I really love this policy,” Paul says but advises, “it’s not a replacement for your regular revenue protection for corn and soybeans.” Get those, then consider WFRP as an umbrella coverage, he suggests.

“From our perspective at NAU Country, we have done a good job with agent workshops helping agents . . . understand WFRP and we do expect an increase over last year,” Paul says.

For more news, go to: www.Agri-Pulse.com