Louisiana's Sabine Pass liquefaction terminal pumped up its U.S. liquefied natural gas (LNG) exports in 2017, reaching 1.94 billion cubic feet per day (Bcf/d). Exports were quadruple that of 2016 shipments, averaging 0.5 Bcf/d.

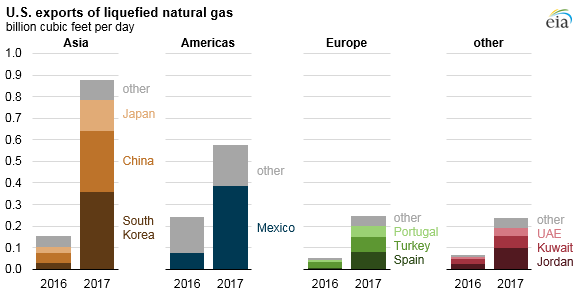

The increased exports opened up the market to more locations, reaching 25 countries total. Mexico received 20 percent of the exported LNG as the country's demand for natural gas ballooned primarily to feed electric generation plants. The country was even more reliant on those shipments due to construction delays of domestic pipelines connecting to U.S. export pipelines. The four U.S. pipeline projects were projected to supply 3.5 Bcf/d to new natural gas-fired power plants in the states of Chihuahua, Nuevo Leon, Sonora, and Sinaloa.

Asia gobbled up another 33 percent of U.S. LNG exports, with most of those shipments going to South Korea (18 percent) and China (15 percent). The increased shipments are credited to a widening difference between the Henry Hub natural gas price and crude oil. While exports to South Korea were primarily part of long-term contracts between sellers Cheniere Energy and Shell, exports to China were sold mostly on a spot basis. Those buys were meant to supplement volumes in October, November, and December when China experienced a record-high LNG demand.

Almost 60 percent of U.S. LNG in 2017 was sold on a spot basis to more than 20 countries in Asia, North and South America, Europe, the Middle East and North Africa, and the Caribbean. Although liquefaction capacity at Sabine Pass is fully contracted under long-term contracts to various buyers, flexibility in those contracts’ destination clauses allows U.S. LNG to be shipped to any market in the world.

European countries claimed the third-largest share of U.S. LNG export capacity. LNG imports by several European countries increased in 2017, driven by increased demand primarily from the power generation sector. South American LNG imports declined in 2017. Demand for natural gas in that region is highly variable and is affected by the availability of competing lower-cost natural gas supply and hydro generation output.

The increase in LNG exports over the past two years is the result of the continuing expansion of U.S. LNG export capacity. Two LNG projects—Sabine Pass in Louisiana and Cove Point in Maryland—have come online since 2016, increasing U.S. LNG export capacity to 3.6 Bcf/d.

Four more projects are scheduled to come online in the next two years: Elba Island LNG in Georgia and Cameron LNG in Louisiana in 2018, then Freeport LNG and Corpus Christi LNG in Texas in 2019. Once completed, U.S. LNG export capacity is expected to reach 9.6 Bcf/d by the end of 2019. As export capacity continues to increase, the United States is projected to become the third-largest LNG exporter in the world by 2020, surpassing Malaysia and remaining behind only Australia and Qatar.