The U.S. solar market added 2.5 gigawatts (GW) of photovoltaic (PV) power in the first quarter of 2018, according to a report from GTM Research and the Solar Energy Industries Association (SEIA) released today. The market showed a 13 percent year-over-year increase and a 37 percent quarter-over-quarter increase.

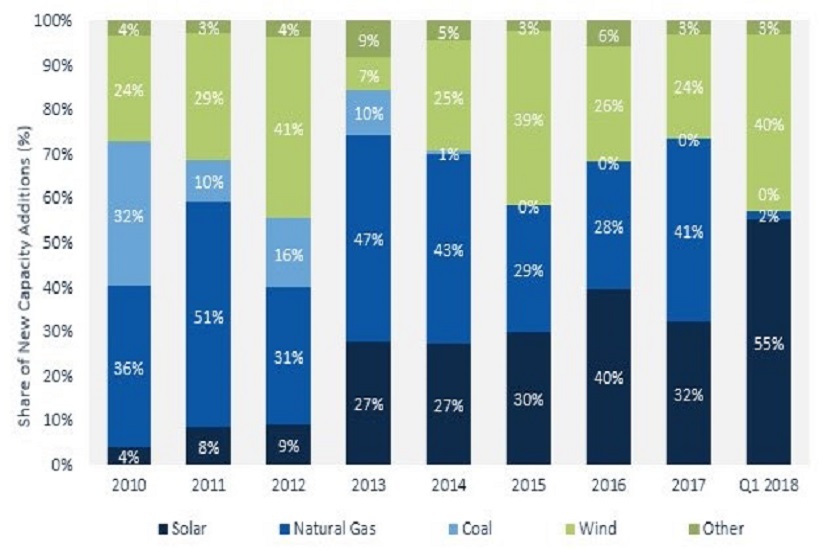

The U.S. Solar Market Insight Report revealed that solar accounted for more than half of all U.S. electricity capacity additions in the first three months of 2018, claiming 55 percent of the added power. It is the second consecutive quarter in which solar accounted for the largest share of new capacity additions. Market analysis suggests that solar’s growth in 2018 will mirror 2017 growth, during which 10.6 GW were added.

“The solar industry had a strong showing in the first quarter,” said Abigail Ross Hopper, president and CEO of SEIA. “This data shows that solar has become a common-sense option for much of the U.S. and is too strong to be set back for long, even in light of the tariffs (on solar imports imposed by the Trump administration). States from California to Florida have stepped up with smart policies that will drive investment for years to come.”

Utility-scale solar industry installations reached 1.4 GW, marking the 10th consecutive GW-scale quarter for the U.S.’ largest solar market segment. Utility-scale installations are now projected to reach 6.6 GW for 2018, up from the March prediction of 6.47 GW. GTM Research said utility-scale projects have been somewhat sheltered from the tariffs. Analysts project tariffs will hit the segment harder in 2019, but still foresee growth.

In the non-residential sector, 509 megawatts (MW) were installed, for the fourth-highest installation total ever in that segment. Additions represent a year-over-year growth of 23 percent. However, the sector declined quarter-over-quarter by 34 percent.

Abigail Ross Hopper, president and CEO of SEIA

Community solar made strong contributions to the non-residential sector, adding 100 MW in Minnesota alone. Experts attribute those additions, in part, to a Minnesota program encouraging community solar development. According to the report, the U.S. now has more than 1 GW of community solar capacity.

The residential PV sector was essentially flat on both a year-over-year and quarter-over-quarter basis. This follows a 15 percent contraction in 2017 and four consecutive quarters of year-over-year declines. GTM Senior Analyst Austin Perea said this suggests that 2018 residential solar will show some improvement over 2017.

“This is a promising indicator that constraints to residential PV growth like segment-wide customer acquisition challenges and national installer pullback are abating,” Perea said. “However, these problems are not entirely solved, as we’re seeing slowdowns in states with a relatively high penetration of PV installations.”

Maryland, New Jersey and New York were among the top five states for residential solar installation in 2017. The report indicated installations in all of those states will shrink in 2018. But Perea believes declines “in some major state markets will be offset by growth in emerging markets.”

Florida emerged as a standout state in the GTM/SEIA report. The state added more solar in the first quarter of 2018 than it did in the entire year of 2016. It was the first time ever that Florida was ranked among the top five states for quarterly installations.

GTM Research anticipates the U.S. market in aggregate will be flat this year. The industry expects more robust growth in 2019 and further acceleration in installations in 2020. The U.S. market can again expect to see growth exceeding 10 percent in the early 2020s, driven in part by California’s recently announced policy requiring solar on all new homes. The report forecasts that within five years, California’s new home solar market alone will be larger than the second-ranked state residential solar market, New Jersey, by 100 MW.

By 2023, more than 14 GW of solar will be installed annually, according to report forecasts.

For more news, go to www.Agri-Pulse.com