Check out the first episode of Agri-Pulse Deep Dive on Dairy, a 30-minute podcast offering a comprehensive look at a wide range of issues facing the dairy industry. The full episode can be heard here, or the transcript can be read below.

You can subscribe to the podcast and listen on iTunes.

Got milk?

You’ve probably seen the iconic imagery at some point or another, whether you were flipping through a magazine or visiting a school cafeteria: A photo of a celebrity with a rim of dairy goodness along their upper lip and a glass of it in their hand. You’ve probably even recreated the imagery on your own unintentionally after a hearty sip. Or, let’s be honest, you knew what you were doing and got a good laugh out of it.

That advertising campaign is one of the most successful in recent American history. Since it was introduced in 1993, it’s hard to imagine anyone in the country who hasn’t seen it. Maybe it made them reach for a napkin, maybe it made them reach for an extra half-gallon. Either way, those two words invoke immediate recognition to countless people.

Right now, the American dairy industry has got plenty of milk; the struggle is what to do with all of it. Changing consumer behaviors mean changing industry practices. A shift in their clout on Capitol Hill leaves dairy lobbyists working to adapt to their new normal.

Couple together the recent wave of bankruptcies among producers and a push to communicate — and improve upon — the sustainability efforts in the industry, and today’s dairy sector is almost unrecognizable from the scenes and images of the past.

We’ll explore all that and more on this season of Agri-Pulse Deep Dive starting with episode one: Boom and Bust.

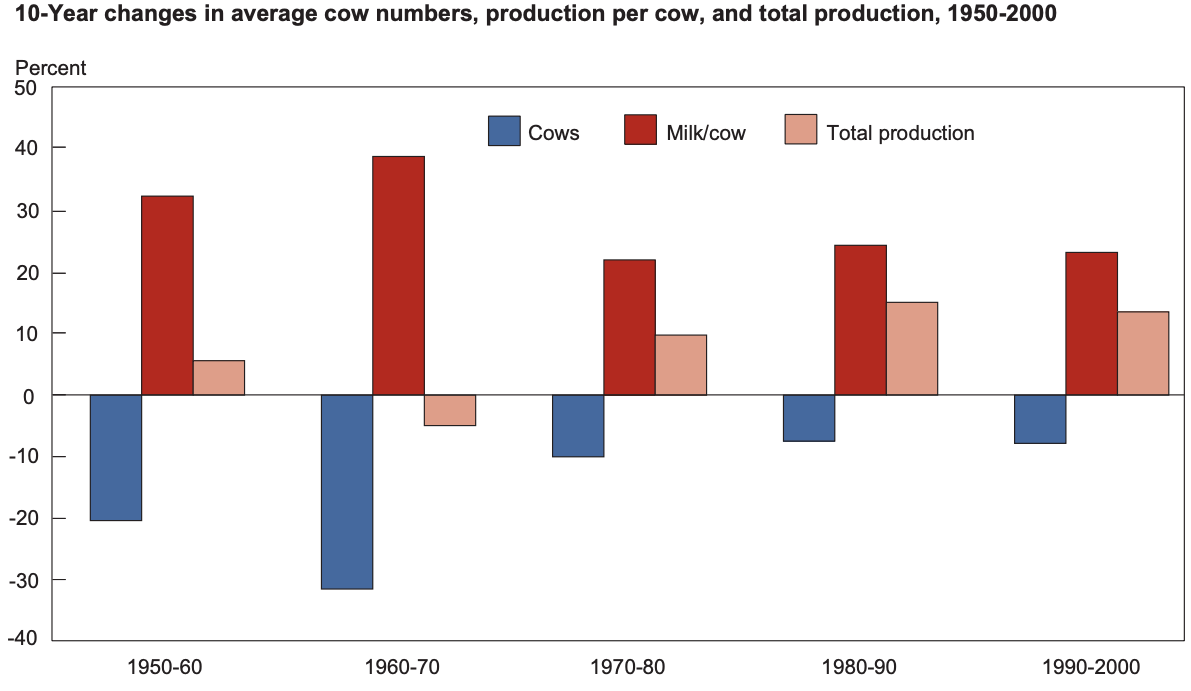

Today there are roughly 9.5 million dairy cows in the U.S. producing nearly 220 million gallons of milk each year. According to USDA’s National Agricultural Statistics Service, the average dairy cow today produces over 23,000 pounds of milk. Compare that to 10 years ago where the number was around 20,500. That is double the production of 1975 of just over 10,000 pounds and roughly five times higher than in 1950 when cows produced just 5,000 pounds per year. Milk production numbers have skyrocketed since the '70s. We’ll talk about some of the driving factors in a moment.

However, the number of farms continues to drop. According to the 2012 Census of Agriculture, there were some 64,000 operations. Today there are some 37,000.

Compare that to 1975, where there were roughly 11.1 million cows on over 400,000 operations producing a total of 115 million pounds of milk a year. According to USDA’s Economic Research Service, most of those farms milked under 200 head. You didn’t start to see an increase in farm herds above 200 head until the 1990s. So, when was the golden era for dairy?

University of Wisconsin Dairy Economist Mark Stephenson says like any sector in the ag industry, there are good years and bad years. I caught up with Stephenson at World Dairy Expo in Madison, Wis., earlier this year.

By the way, if you’ve never been to World Dairy Expo, let's break it down: Folks from around the world descend on Madison, Wis., for a five-day show dolling up cows and parading them around an arena of judges. It’s like a beauty pageant except for our four-hoofed friends and if you don’t think its competitive, you’re only kidding yourself.

Cutting Edge T Delilah made history October 2019 for the second year in a row, becoming the only Brown Swiss to ever claim back-to-back World Dairy Expo Supreme Champion titles.

Yeah, people get creative with the names with ones like Milksource Thunder and De La Plaine Bingo Stinger.

You’ll also never go hungry of cheese curds, ice cream, and milk. It's a lactose intolerant’s nightmare ... but if you go, Ben highly recommends the grilled cheese tent.

Nuelle: “As far as just breaking down where the economy for the dairy industry is right now, how would you describe that and where it is going?”

Stephenson: Well, right now we’ve got a milk price that I would say we could feel like is fairy average — reasonable. But you know this is to say for most folks you can probably have your nose above water if this was something that was typical. But we‘ve been through five years of relatively low milk prices and people’s balance sheets have been badly damaged trying to secure credit and loans to just pay for the operating costs of a business. They need a little bit more than just average prices to help restore some of that.

Nuelle: And just remind me, what is good milk price where a producer can sustain itself?

Stephenson: That is a question that sounds like I should be able to give you, just something right down to a penny but honestly, we see a broad range of cost of production every year. It moves up and down from one year to the next as costs of production change but we see a big range between our lowest cost farms and our highest cost farms. Which by the way, is about the same for all farm sizes. I hear so many people say ‘Boy, large farms, absolutely hands down that’s the low cost of production’ but our best small farms have as low cost of production as our best large farms do.

Nuelle: As far as big versus small, what are you seeing for the makeup there in Wisconsin or across the nation?

Stephenson: That has been a moving target for a long period of time. We peaked back in the 1930s in terms of dairy farm numbers and we’ve been consolidating those ever since. We’ve been producing way more milk than we ever have before. Our remaining farms are getting larger and just producing quite a lot more milk. That is going to continue. I don’t see any reason for that to stop or even stabilize now.

Stephenson says some of that just has to do with the technology we saw at Expo.

"You can’t look at some of these feed mixer wagons and say, ‘I’m going to feed my feed mixer wagons with that.’ It’s way too expensive," he said. "It’s too much capital. The same thing was true for the bulk tank in the 1950s. It meant that you had to become bigger to have that on your farm and pretty soon you had to have that to ship grade A milk. Some of these things just push us to larger operations."

He says you really can’t pin down when there was a specific heyday for the dairy industry.

“I don’t know. I mean we can be nostalgic, I mean we can be nostalgic about a period of time," Stephenson said. "I loved climbing in the hay loft throwing the bales down but people are happy not to do that now. So I don’t think there is a golden era for dairy. It changes. These large dairy farms are wonderfully operated farms. These cows are comfortable on these large farms. They are getting a quality of feed that they have never gotten before. I mean it’s great. I don’t think you can look at that and say ‘gosh that’s bad.’ By the same token, that is not going to be for everyone, we see successful business models of all types."

Mark Stephenson

Assistant professor in applied economics at the University of Minnesota, Dr. Marin Bozic, agrees with Stephenson. He says it all depends on what kind of dairy farmer you are.

"How ambitious you are; how efficient you are and your cost of production. Certainly there are farmers today that are planning expansions and some of them already have expansions already planned out a few years ahead," Bozic said. "They are bringing in next generation, etc. And other farmers are finding the prices we had the last few years were too much or not enough.”

He says it also depends on where your operation is located.

"If you are in California, you’re facing ever-increasing regulatory burdens and also competing opportunities from the almond sector, pistachios and others.”

Third-generation California dairy farmer Steve Maddox knows all too well about the impacts of regulatory burdens. He runs a large diversified dairy operation near Riverdale.

Maddox: “I’ve got 3,900 cows milking and dry. Plus 4,000 head of heifers, 1,200 head of breeding bulls and everything is 100% registered. If we’re not the largest registered herd in the United States, we’re close. We merchandise genetic stock around the world. We have an embryo transfer lab. We sell embryos, bull semen, and live cattle.

Nuelle: On the environmental front, has that been a challenge for you?

Maddox: We have a large land base, obviously with what I’ve got. So we’re able to spread the effluent and we do our soil testing, we do our water testing, effluent testing, all the above. On our corn and our alfalfa we are able to grow those crops without any commercial fertilizer but that has made us more efficient. The excessive reporting of air quality and water quality is a little tedious. We have three different air boards we have to report to, we have two water boards we have to issue with. Now our state is trying to control our groundwater, which we’re the only state of the western 13 states where the state doesn’t control the groundwater, so trying to be better stewards of that with water banking and the like, so it is part of an everyday thing.

Dr. Bozic said also the economics are different in different states across the country.

“Contrast that to South Dakota where people just can’t get enough calves as they need for the cheese plants there," Bozic said. "South Dakota has probably grown 25% over the last five years in the number of cows and they hope to grow another 50%.”

“What is driving consolidation and smaller herds?" Agri-Pulse asked Bozic.

Marin Bozic

"Driving the need for less cows in general, in aggregate, is indeed the case that we are very good of improving the genetics of dairy cattle that are being used in production," he said. "Every new generation of cows produces about 1.2% more milk than the generation the year before. That is what is driving more milk even if you have the same aggregate number of cows. What has been driving consolidation — the exits of typically smaller farmers and rise of typically larger farms, though you can be a very successful small farmer and a terrible large farmer. It's not a universal rule but more of a trend.”

What’s been driving consolidation of small farms is that their cost of production typically is larger than a bigger operation where you can spread out fixed costs. Keep in mind, this is family business too, which means every 20 to 30 years there’s a new generation that is contemplating whether they will come back to the farm, move to the city, or take another supporting role in the agribusiness sector.

Bozic: If you have a small operation perhaps you may not have reinvested in, the barns are old, a lot of things need fixing, well then your son or daughter may say ‘well you know Dad I appreciate everything you do, working hard, I like your ethic, but I don’t see myself in this business, on a farm like this going forward, and then it is that attrition through the choices of the next generation that is driving more consolidation.

Nuelle: How do bankruptcies fit into all of this?

Bozic: The bankruptcy itself is a reorganization. So you would go through the process of bankruptcy, you believe there is light at the end of the tunnel but you just need to reorganize your debt and that’s forgiven so you can start fresh. But there is another way out, and that is just to sell everything. You sell your equipment, you sell your cows, you sell your facilities if you can.

According to a July 2019 analysis by the American Farm Bureau Federation, the number of Chapter 12 filings from June 2018 to June 2019 reached 535 filings, which is the highest level since 2012’s 582 filings. Chapter 12 filing is designed for family farmers with regular annual income who are financially distressed to propose and execute a plan to pay all of their debts. Wisconsin, Kansas and Minnesota led the nation in Chapter 12 filings. Bankruptcy filings in Kansas and Minnesota increased so sharply they reached some of the highest levels of the last 10 years, the AFBF report said. But Bozic says you have to be cautious in how you interpret the bankruptcy numbers because the number of bankruptcies aren’t the only indication for the current status of the ag sector.

"What we’ve seen the last few years that is different than the previous crises and we’ve had cyclically low dairy prices — 2003, 2006, 2009, 2012 we had good milk prices but feed prices were high" he said. "Some people would say that they would come every three years. It’s not as precise, it's not a mechanical clock, but there is some periodicity to this."

But Bozic says what is different about the most recent cycle or the last few years, the industry cannot simply rely on those who wish to retire to balance the supply. In the past, when milk prices would be low, those who wished to expand operations would press the brakes, wait for people to retire and eventually see demand catch up with supply again.

"What we’ve seen is that the last few years is that we’ve seen bankers have to tell a number of dairy farmers 'look, this is not going to work out. We don’t see a scenario in the next five years where you can be successful.’ And that is tough. That’s really tough," Bozic said. "We are not just talking about families that would have retired anyways in the next three years. We’re talking about 35-year-olds, 40-year-olds that maybe have just started a family, maybe had a dream of owning their own farm and now have to completely re-envision their life and that’s tough. We’ve seen a number of cases over the last few years."

Bozic noted certainly these are challenging times for many dairy producers but also times where a number of them see opportunities in the next decade.

Up next, we'll dive into some of those opportunities.

Agri-Pulse Deep Dive is brought to you by Edge Dairy Farmer Cooperative — the voice of milk. Edge provides dairy farmers across the Midwest with a strong voice — the voice of milk — in Congress, with customers and within communities. Edge is an energetic, forward-thinking organization that represents all dairy farmers equally, recognizing both their differences and similarities. As one of the top dairy cooperatives based on milk volume, Edge amplifies the voice of farmers. Now, more than ever, dairy farmers need to be heard. Join us at VoiceofMilk.com.

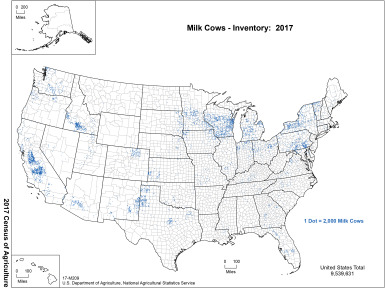

Tucked away in a stack of maps accompanying USDA’s 2017 ag census is one displaying the milk cow inventory for that year. It’s black and white with state and county borders, but blue dots scattered across the landscape represent dairy cows, 2,000 head per dot.

Working east to west, there’s pockets of production in southern Pennsylvania and western New York with smatterings of dots in Ohio, Illinois, and Michigan before the dots get much more concentrated in Eastern Wisconsin. The nearly solid color on the eastern part of the state gradually fades to nothing across the southern half of Minnesota and the eastern quarter of South Dakota. Aside from a few portions of increased density in west Texas, eastern New Mexico, northeastern Colorado, southern Idaho, and southwestern Arizona, the only other solid concentration cuts northwest to southeast through the center of California.

A separate map shows change of inventory from the previous census, which was completed in 2012. That map shows significant increases and decreases in the dairy cattle herd across the country, but doesn’t really quantify what it means by “significant.” Either way, many of the significant decreases happen in southern California and northern Minnesota. The significant increases are spread throughout the western United States, but a collection of counties in eastern South Dakota along the Minnesota border all show increases.

That’s not an accident. The change of inventory map in the 2012 census shows the same thing. It’s part of a long-running effort in the Mount Rushmore State to attract more dairy production.

Joe Flata is a Director in the South Dakota Governor’s Office of Economic Development. Basically, it’s his job to be a salesman for a state and court interested businesses looking to plant roots in the state. One thing he’s always got in his back pocket? The state’s tax structure.

“We are a state that … we are frugal first of all, and we try to leave as much of the dollar in the producer’s pocket as we can," he said. "And we try to be super-efficient. And people like that kind of approach, especially people with an ag background, because they know the value of that dollar. So that’s important, and then our tax structure is important, especially the corporate level. So that’s where we get into that conversation about ‘Does it make sense to keep some of your dairies in California but have your headquarters in South Dakota because there’s no corporate income tax?’ And there’s no individual income tax.”

But a business-friendly system of governance can only get you so far when trying to recruit an ag operation. At a certain point, they’ll need land, and lots of it. Most of the dairy industry’s growth in the state has been along the Interstate 29 corridor, a belt of highway on the eastern side of the state that’s usually not too far from the Minnesota border. From an economic development perspective, Flata says it checks a lot of the necessary boxes, and local communities have taken notice.

“There’s ample natural gas, there’s ample electricity. Of course, the interstate system on I-29, and then it connects with I-90. Good railroad service. And then with the supply chain, there’s a ready purchaser of the milk that’s kind of lined up along that I-29 corridor," Flata said.

"There are several large cheese producers who have lined up along I-29 or near I-29. And I think that plays a pretty big role in that. And then probably, and this is probably a key as well, the permitting process. Getting permits so someone can start a dairy or expand a dairy, those counties, many of them at least along I-29, have focused on making it as easy as possible to get a permit. Sometimes that’s easier said than done, but I think those counties, a number of them, have tried to work through that and make it relatively simple.”

But bringing those producers, and those cows, to the area hasn’t been without its challenges. Dairies need employees, employees need housing, housing needs to be built, sometimes there’s children to send to the local school system. And what about all that milk? There needs to be a good road to come pick it up, a licensed trucker to drive a reliable truck down the road to come get it, and that truck needs to go somewhere.

Allen Merrill is a dairy farmer from Parker, S.D. He and his son run a dairy that milks 200 cows per day, continuing an operation that was started by Allen’s parents. He’s also the chairman of the Midwest Dairy Association. That’s the dairy checkoff arm of 10 states stretching from North Dakota to Arkansas.

Here's a quick checkoff 101 for those who might not be familiar. Checkoffs work to fund research and promotion of agricultural commodities as well as build demand for their products. Remember the “Beef: It’s What’s for Dinner” commercials? That was a checkoff project designed to advertise a commodity. Checkoffs are funded by producers themselves through an assessment on what they sell. In the case of the dairy industry, producers pay an assessment of 15 cents per hundredweight of milk. For producers in the 10-state region covered by Midwest Dairy, 10 cents goes to them, another five goes to Dairy Management Inc, the national arm of the checkoff.

We talked with Allen about a major issue facing the dairy industry in his part of the country, and frankly, nationwide: processing capacity. Using South Dakota as a case study, that expanded dairy production needed to go somewhere. That led to a look at the state’s processing capacity and discussions about what should come next.

And what came next was construction of additional facilities to handle all that milk. There’s the $140 million facility in Brookings that started production in 2014, the $250 million expansion of a cheese plant in Lake Norden announced in 2018, and that’s on top of other facilities already up and running in the state.

But how do these kinds of decisions get made? How does a company know just where to put shovels in the ground?

As Allen puts it, there’s a number of factors.

“It involves a community that’s willing to have a processing plant of that nature, because it does change a few things, a state that’s willing to recognize there’s an investment happening here where we benefit from this because it does create jobs," he said.

Allen Merrill, Midwest Dairy

"One reason Belle Brands chose Brookings was because we had a very good college that we had a lot of research and innovation type work there that Midwest Dairy invests some money into research, so I think you saw value there," Merrill added. "And that’s some of the process, but having an understanding of what the community will do to also allow the milk to be close to a processing plant. A lot of plants like to have their milk within 100 to 150 miles there. It stays local, you don’t spend a lot of transportation costs getting the product to the processor. So that’s what I see as a benefit of having plants, especially on this east side of South Dakota, and that’s why you see the growth in this area.”

Allen and other producers in the area are kind of lucky. He’s a member of a co-op that is able to sell milk to a few different processing plants, depending on market factors. But as the beef industry learned last year when a packing plant in Kansas caught fire, processing capacity is a fragile thing. And the dairy industry could ill afford to lose a plant.

“Most of the processing plants are probably running at 95-98% capacity, which is a huge, huge part," he said. "Because years ago, and I’m talking 25-30 years ago, they probably ran 80-85%, so they always had room for extra milk whenever something had a hiccup in the system. I think today, we don’t have that much flexibility.”

“You think of a large plant that’s taking in 9, 10 million pounds a day, where are you going to go with that milk if they have a breakdown or a fire or a shutdown? It’s very concerning," he added. "Years ago, we could handle it, I don’t know if we can today. We could cover maybe half of it.”

All of this: all the recruitment and all the growth. All the processing and all the product differentiation, every new facility and every dollar invested is done up against one simple fact: people aren’t drinking milk like they used to.

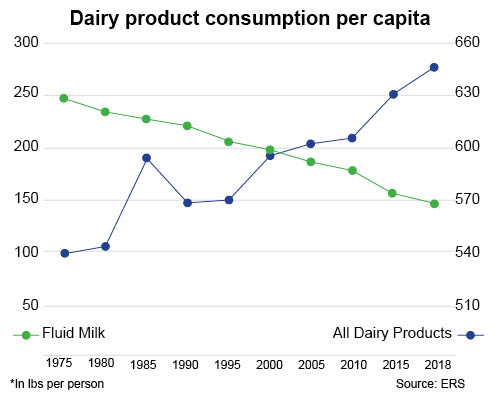

The Department of Agriculture tracks dairy consumption across a whole host of categories. Milk, butter, cheese, yogurt … pretty much any dairy product you put into your grocery cart is somehow measured. The numbers are displayed on a per capita basis in pounds and date back to 1975 and run through 2018, the most recent year with complete records.

For fluid milk, the 1975 measurement showed 247 pounds of annual per capita consumption. By the time 2018 rolls around, that dropped all the way to 146. That’s a drop of more than 40%, a few bowls of cereal over losing a whole 100 pounds of consumption per person.

But it’s not necessarily time to cry over spilled milk. Totaling up everything — all the milk, butter, cheese, yogurt, ice cream, whey powder, all of it — shows overall consumption is up from 539 pounds of milk equivalent consumption in 1975 all the way up to 646 in 2018. Keep in mind, that increase of 107 pounds of total consumption comes at the same time there was a 101-pound drop in fluid milk consumption.

People are still getting their dairy, just like they used to.

“We are eating our dairy. We’re eating it in cheese, we’re eating it in yogurt, we’re getting it in butter, we’re getting it in protein added to sports drinks and to nutritional bars, so we’re consuming our dairy in different ways. Cereal consumption’s off. The way Americans are having meals at home — breakfast with a bowl of cereal — we aren’t doing that anymore. We use the term here, Spencer, that milk kind of came along for the ride with a bowl of cereal. Well, if there’s no bowl of cereal, there’s no place for milk to ride along with.”

That’s Michael Dykes, the president and CEO of the International Dairy Foods Association. Among its members are about 90% of the fluid milk processing capacity in the country. Long story short: If you have a dairy product in your fridge or freezer, there’s a good chance an IDFA member had something to do with it.

Agri-Pulse talked with Michael recently in his Washington, D.C., office. We asked him: If fluid milk is no longer as popular as it once was, what does that mean for his members?

Chase: “If we’re eating more of our dairy rather than drinking it as we traditionally have as you point out, that requires an extra step or two in the process to turn that milk from a cow into cheese, into butter, into yogurt. How does that shape industry behavior?”

Dykes: “Well, it says that the folks, our IDFA members who are doing all the processing, they have to be thinking about what types of plants they need, what types of equipment they need, they have to have access to capital to be able to make those changes — modify plants, build new plants, expand plants — those are all part of the planning horizon, and having the market intelligence to anticipate where the market is going to go, and be prepared to meet that need once it gets there.”

Michael Dykes

That’s a delicate balance. Overestimate the consumer’s demand for Product A, and suddenly you’re caught flat-footed when consumers want more of Product B. Anyone that’s been in the dairy business — or any sector of agriculture, heck any sector of business — can probably tell countless stories of swinging and missing on just what consumers were looking for.

But consumers are the ones with the purchasing power. And as Dykes puts it, that dynamic isn’t going anywhere.

“We’re going to see more change in the next five years in the U.S. dairy industry than we’ve seen in the last 15," he said. "I’m a kid that grew up on a dairy farm milking cows when I was five years old, I’ve been a dairy veterinarian, I still own farms today, I was just on farms during the holiday with my brothers with beef cows, agriculture’s changing. And we’ve got to accept that it’s changing. And we’ve got to accept that the consumer is our boss, and the consumer’s changing. And we’ve got to meet the needs of the consumer, whether we like that or not, it’s just a fact of life; They’re changing.”

Our conversation with Michael had interesting timing; it took place on the same day Borden Dairy in Dallas announced its Chapter 11 bankruptcy filing, becoming the second processor to do so in three months after Dean Foods initiated similar proceedings in November.

But as we learned earlier, they’re far from alone. And they’re far from the only segment of the industry facing some challenging times. So what can be done about that? How can the industry adapt to changing consumer preferences? And what does Capitol Hill have to do with it?

We’ll explore that and more as we look at the policies and politics of the dairy industry next week on Agri-Pulse Deep Dive.

For more news, go to www.Agri-Pulse.com.