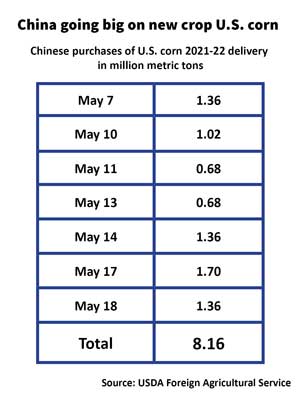

Editor’s note: The USDA announced yet another export sale of 1.36 million metric tons of U.S. corn to China for the 2021-22 marketing year Wednesday morning after this story was published.

China is buying extraordinary levels of U.S. corn and much of that demand comes from the country’s race to modernize its pork production — a mission that’s expected to sustain a long-term increased reliance on grain and oilseed imports, according to U.S. government and industry officials.

Much of China’s recent buying spree in the U.S. will likely go to refill the country’s reserves, but some of it is also going directly to feed mills as the Chinese government aims to overhaul its ability to produce pork, protect its vulnerable swine herd from African swine fever and clean up the environment, say U.S. officials and analysts who monitor the Chinese industry.

“They are building out these western-style confinement operations aggressively,” says Gregg Doud, former chief agricultural negotiator for the Office of the U.S. Trade Representative during the Trump administration and now chief economist for Aimpoint Research. “And of course, if you’re going to do that, what’s the next thing you’re going to do before you fill that facility full of pigs? You’re going to lay in the feed supply — which is what they’re doing. And they’re going to continue to do it.”

And the evidence they are doing exactly that is the massive amount of soybeans and corn China continues to purchase from Brazil and the U.S.

China is buying Brazilian soybeans from its latest harvest and snapping up U.S. corn at a blistering pace.

China bought about 22.63 million tons of the 2020-21 U.S. corn crop. And now China is buying millions of tons of the next U.S. corn harvest.

Gregg Doud

In the last 13 days, China has committed to buying 8.16 million metric tons of U.S. corn for delivery in the 2021-22 marketing year, according to USDA data. Mexico is a distant second, having purchased roughly 2 million tons so far of new crop corn from the U.S.

USDA on Tuesday announced just the latest of China’s purchases of new-crop U.S. corn — 1.36 million tons. That followed a 1.7-million-ton purchase on Monday.

U.S. analysts say they believe COFCO, China’s state-owned grain company, has been responsible for most or all of the country’s recent corn-buying blitz.

Cary Sifferath, the senior director of global programs for the U.S. Grains Council, says China auctioned off about 55 million tons of corn from its reserves last summer, and the country will need to replenish those supplies, but feed demand is so high that a lot of the grain and oilseeds are going to meet that demand.

“Reports on the ground say most of the corn that’s arriving is going straight to feed mills and being used right away,” Sifferath told Agri-Pulse.

And there are more large-scale, modern hog farms in China than ever before.

The African swine fever outbreak in China in 2018 accelerated the country’s push to overhaul its pork production industry, but that’s the direction the Chinese had already been going for years, say U.S. China-watchers. During a push to clean up the environment back in 2013, the Chinese government began forcing the closure of small, family-scale hog operations, most of which did not have efficient systems to deal with waste.

Before ASF, large-scale confinement operations accounted for about 10% of China’s pork production, but that’s now 15-20% after the disease outbreaks accelerated the government’s push to modernize, according to a U.S. government official who asked not to be named in this article.

Interested in more news on farm programs, trade and rural issues? Sign up for a four-week free trial to Agri-Pulse. You’ll receive our content - absolutely free - during the trial period.

As many as 20 Chinese companies, aided by government subsidies, grants, easy credit and discounted insurance, ramped up construction on new facilities, the official said. Large private companies like Wens Foodstuffs Group and Tianjin Baodi not only pushed Chinese pork production higher, but also created new demand for corn and soy-based feed.

An official with China’s Ministry of Agriculture and Rural Affairs (MARA) told an audience at the 2021 China Feed Industry Expo and Conference that “large-scale slaughterhouses processed 14.2 million pigs in February, up by 71% year-on-year,” according to a USDA official who attended the event.

The MARA official also said Chinese mills produced 252.8 million tons of feed in 2020, a 10.4% increase from production in 2019.

The Chinese government has outlawed feeding food waste to pigs, and that’s adding to the forces that are shutting down smaller operations that survived by feeding leftover rice, noodles, dumplings and bread to their livestock, says Sifferath.

Cary Sifferath, Grains Council

He says he estimated that replacing all of that food waste with professional feed would translate into the consumption of 30 million metric tons of feed. However, that may be a conservative estimate, he said, noting that other estimates are as high as 40 million tons.

A new report out of the USDA Foreign Agricultural Service office in Beijing says the “latest rounds of ASF outbreaks are expected to heavily impact small and family-sized swine farms” and noted many “will find it difficult to survive, let alone expand their herds and operations, under the pressure of falling pork prices, high feed prices, and pig losses.”

The practice of feeding restaurant scraps to pigs is also an ASF risk, said Sifferath. There is pork in that waste and if it is infected, it can reintroduce the virus to healthy pigs.

“It doesn’t pay to bring back older operations,” Sifferath said. “You’re almost guaranteed to have ASF reenter without new biosecurity measures.”

For more news, go to www.Agri-Pulse.com.