Four years after the farm bill legalized industrial hemp nationwide, crop acreage is falling as the industry struggles to get regulatory clarity and infrastructure for products derived from the plant’s grain and fiber.

State regulatory and industry representatives say the potential markets for the plant are huge, but a continued lack of clear direction from the federal government, particularly from the Food and Drug Administration, and roadblocks created by USDA regulations are hindering growers.

The impact on licensed and planted acreage is evident in figures reported by state agencies. Licensed acres nationwide jumped from 78,000 in 2018 to around 500,000 acres in 2019 and 2020 before dropping by about half to 235,000 acres in 2021, according to Beau Whitney of Whitney Economics in Oregon. Based on partial state reporting, he estimates the licensed acreage this year will be about 95,000 acres.

Not all of that is planted, however, as Whitney notes that many growers maintain their licenses even if they don’t plant hemp, in some cases because they have excess inventory that they want to sell.

Earlier this year, USDA’s National Agricultural Statistics Service, in its first-ever survey of the hemp growing landscape, estimated that last year, 33,500 acres were harvested out of more than 50,000 acres planted.

Most of that was for cannabidiol (CBD), for which there is no clear regulatory path. FDA has said repeatedly that CBD or THC products cannot be sold as dietary supplements, nor can any food product to which THC or CBD has been added. CBD is one of dozens of cannabinoids found in hemp and has been touted for its therapeutic properties.

The National Institutes of Health calls CBD "a non-intoxicating and generally well-tolerated constituent of cannabis which exhibits potential beneficial properties in a wide range of diseases, including cardiovascular disorders."

Despite FDA's stance, there has been growth in CBD products, but most in the hemp industry want to see an expansion of the grain and fiber market. The market for hemp-based products is there, but the infrastructure is not.

After the 2018 farm bill was passed, thousands of growers jumped into the hemp market, lured by the promise of a big payday from the highly touted new crop. Production and CBD prices soared. But the market couldn’t handle all the hemp that was produced, and many growers were left with excess supply.

“The recent decline in acreage is largely due to the 2019 surplus production that has not yet been depleted,” Colorado Department of Agriculture Commissioner Kate Greenberg told a House Ag Committee subcommittee July 28.

“Other factors include the economic disruptions caused by COVID-19, additional states producing hemp post-2018 Farm Bill, and the fact that infrastructure for food and fiber production from hemp has largely not been developed,” she said.

Whitney says regulatory uncertainty around the status of CBD has had a ripple effect. Hemp, he says, has been unfairly singled out because it can be used to produce Delta-8 THC, which also has psychoactive effects, but which FDA says is sometimes synthesized using potentially harmful chemicals. Whitney, however, says policymakers do not necessarily appreciate the diverse uses of hemp, particularly in the fiber and grain sectors.

Legislation has been introduced in Congress to increase the amount of total THC to 1% from the current limit of 0.3% delta-9 THC, which would address the delta-8 issue but has also caused delta-8 manufacturers to warn that their industry could be adversely affected.

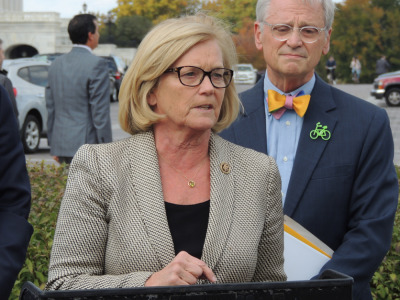

Rep. Chellie Pingree, D-Maine

Rep. Chellie Pingree, D-MaineRep. Chellie Pingree, D-Maine, whose Hemp Advancement Act includes the 1% THC level, said at the subcommittee hearing her legislation would also remove the USDA requirement that hemp testing occurs in DEA-registered laboratories, a particular challenge in Maine where there are no such facilities.

Greenberg agreed, saying the 2018 farm bill “placed many significant burdens on hemp producers, including much higher sampling and testing fees, completing required background checks, and [Farm Service Agency] acreage reporting, which is duplicative in nature because it is already reported to the USDA through state reporting.”

Pingree echoed those concerns, noting background checks have been especially burdensome in Maine. “Employees are struggling to get fingerprints that are acceptable by the FBI for criminal history reports,” she said. “One grower told us that he had to be printed five times before it finally worked.” There is only one post office in the largely rural state that does fingerprinting.

And Eric Wang, CEO of multinational firm Ecofibre, said at the hearing that “public statements by FDA officials stating that it is unlawful to sell ingestible hemp-derived CBD products have taken their toll on the industry. CBD commerce and investment have been chilled due to continued inaction at the federal level, impairing economic opportunity for American farmers.”

Don’t miss a beat! It’s easy to sign up for a FREE month of Agri-Pulse news! For the latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

Whitney said in a piece posted online that the price of both hemp biomass and processed hemp goods “have collapsed since 2019, falling in some instances by 97% by the end of 2021.” He estimates the slowdown in the industry resulted in potential lost revenue of between $20 billion and $25 billion in 2021 for hemp grain and feed alone — a market he says “is greater than the entire global cannabis opportunity,” including marijuana.

Nevertheless, “while it is true that fiber and grain are on the rise, data coming directly from state agencies show that hemp for cannabinoid purposes is still the main driver in hemp cultivation and production,” Whitney said in an analysis of NASS’s February report, which Whitney said vastly underestimates the value of the hemp market.

Instead of $824 million, as NASS estimated, Whitney said the value of sales in 2021 was closer to $8 billion.

One area generating vast interest is the use of hemp as animal feed. But the path has not been smooth at FDA, which has been reviewing an application submitted by the Hemp Feed Coalition to use hemp seedcake and meal for laying hens.

Raj Kasula, senior vice president and chief nutrition officer at The Wenger Group and a board member of the Hemp Feed Coalition, which applied more than a year ago, said on a webinar Tuesday that FDA’s Center for Veterinary Medicine has asked the HFC to provide more testing data.

The webinar, sponsored by the Association of American Feed Control Officials and the National Industrial Hemp Council, came about after AAFCO, the American Feed Industry Association and other groups warned states not to try to legalize hemp feed on their own.

“Even if a state legalizes hemp for use in animal feed, the use of the ingredient is not yet approved at the federal level,” the groups said in an open letter to ag leaders and policymakers.

“Animal feed containing hemp, as well as human food produced from animals fed hemp, that crosses state lines is subject to federal regulation and could be considered adulterated under the law,” they said.

FDA-CVM’s request for “lower levels of detection of compounds that are physiologically NOT produced” in the seed “is why HFC and the industry at large continues to be frustrated with bureaucratic hurdles strangling the potential of the hemp industry,” HFC said in response. “These feed applications cost roughly $250,000 each, require years to complete, and are specific to the ingredient and the species. At the current rate of approval, it will be millions of dollars and decades before the government allows the hemp industry even an opportunity to compete in the greater feed market.”

On the webinar, FDA-CVM’s Charlotte Conway, deputy director in the Division of Animal Food, said that “unfortunately, sometimes the results of the study create new questions, and that can result in us having those rounds of questions.”

At the congressional hearing, Brandy Phipps, a professor at Central State University in Ohio, called the FDA-CVM process “unwieldy” and expensive.

“A possible solution to that could be infusing dollars into the CVM, in particular, to streamline that process,” she said.

For more news, go to www.Agri-Pulse.com.