(Editor’s note: This is the second article in our new Agri-Pulse series: “The seven things you should know before you write the next farm bill.” Each segment provides important background and ‘lessons learned’ that can help inform and stimulate debate before formal work starts on writing the next farm bill.)

WASHINGTON, Feb. 17, 2017 – Development of a new farm bill usually starts with discussions of needs and wants, and evolves into costs.

Figuring out the farm bill “math” is not for the faint of heart. Agricultural economists spend countless hours making the programmatic goals work within a certain set of parameters – largely dictated by Congressional Budget Office (CBO) projections.

And that doesn’t count all of the internal “scores” that staff members produce – trying to work out the kinks and find solutions before CBO issues an “official” score for members to consider.

And then there’s also the political math behind that farm bill “wish list” – producing a bill that attracts 218 votes in the House and a filibuster-proof 60 votes in the Senate.

How does one make sense of it all?

If recent history is any guide, farmers, ranchers, sportsmen, conservationists, and anyone else who would like to see more money spent on food and agricultural policy could be in a tough spot when lawmakers sit down to write the next farm bill.

Already, there are pent-up demands in the search for more money to help grain, oilseed and cotton farmers who believe they were shortchanged by the 2014 farm bill. Cotton growers alone have appealed, unsuccessfully, to receive new USDA assistance that could cost up to $1 billion over 10 years.

Conservationists and sportsmen’s groups would like more federal dollars for protecting land, water and wildlife resources. And a series of small programs that support growth in small-scale farming, organic production and local and regional food markets will simply run out of money after the current farm law expires in 2018 – unless more funds can be found.

And that’s where the farm bill “math” gets even more complicated.

There appear to be no readily available sources of “new “money to fill the demands. That means that funding the new farm bill could require trimming some existing programs – in other words, robbing the proverbial Peter to pay Paul.

That’s a risky strategy that could intensify infighting among regions and commodities at a time when the House and Senate Agriculture committees already face increased pressure from conservative think tanks and the Freedom Caucus to cut spending. Urban Democrats may see little reason to help.

“I don’t know where this goes. There’s just no money there,” says Bob Young, chief economist for the American Farm Bureau Federation. “I don’t see this Congress, this administration being willing to say OK, let’s throw another whatever at you.”

But then again, we have a new president, a new Congress and a drastically different farm economy compared to when the last farm bill was written.

But then again, we have a new president, a new Congress and a drastically different farm economy compared to when the last farm bill was written.

Past farm bill debates demonstrate that politics and the state of the farm economy will figure prominently in the approach that the Trump administration and Republican-controlled Congress take toward any new farm bill.

For example, President George W. Bush signed the 2002 farm bill, which dramatically increased farm bill spending in the wake of a devastating drop in commodity prices in the late 1990s.

The extra spending did nothing to hurt Republicans politically: The GOP won control of the Senate in the fall of 2002.

President Reagan wasn’t above supporting increased farm spending, either, when the political pressure outweighed his desire to downsize government.

With the farm economy reeling in the early 1980s, USDA spent $10 billion coaxing farmers to take more than 15 million acres of cropland out of production through a payment-in-kind (PIK) program.

Two years later, Reagan’s Secretary of Agriculture, John Block, lobbied for another land-idling program to help boost prices. Block described the Conservation Reserve Program (CRP) as an “agricultural recovery program to put this industry back in the business of prosperity in the years to come.”

CRP enrollment, aimed at retiring “highly erodible” lands for a decade or more, jumped from under 5 million acres in 1986 to over 30 million acres in 1990, costing taxpayers billions of dollars in an effort to boost farm income.

So there’s a strong precedent for asking for federal assistance when needed.

“If we need more resources, we should ask for them,” Chuck Conner, the president and CEO of the National Council of Farmer Cooperatives, said at his group’s recent annual meeting. Conner was Bush’s White House adviser on agricultural policy during the 2002 farm bill debate.

From a political standpoint, lawmakers will likely be paying attention.

The current farm law was enacted in February 2014 and expires in September 2018. That’s just ahead of the midterm elections, when lawmakers representing every House district and 33 Senate seats will be up for re-election. In the Senate, 23 of those seats are currently held by Democrats, 8 by Republicans and 2 by Independents.

Where does the money go?

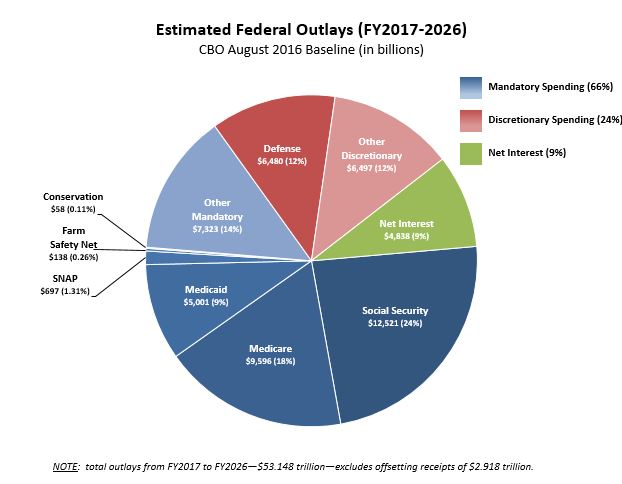

Billions of dollars are spent on supporting farmers, ranchers, rural communities and those in need of food assistance, through hundreds of specific farm bill programs. More broadly, farm bill advocates point out that all food consumers benefit by keeping food affordable and accessible. All in all, farm state lawmakers like to point out that it’s a pretty small slice of total federal spending. (See chart, below, courtesy of the House Committee on Agriculture.)

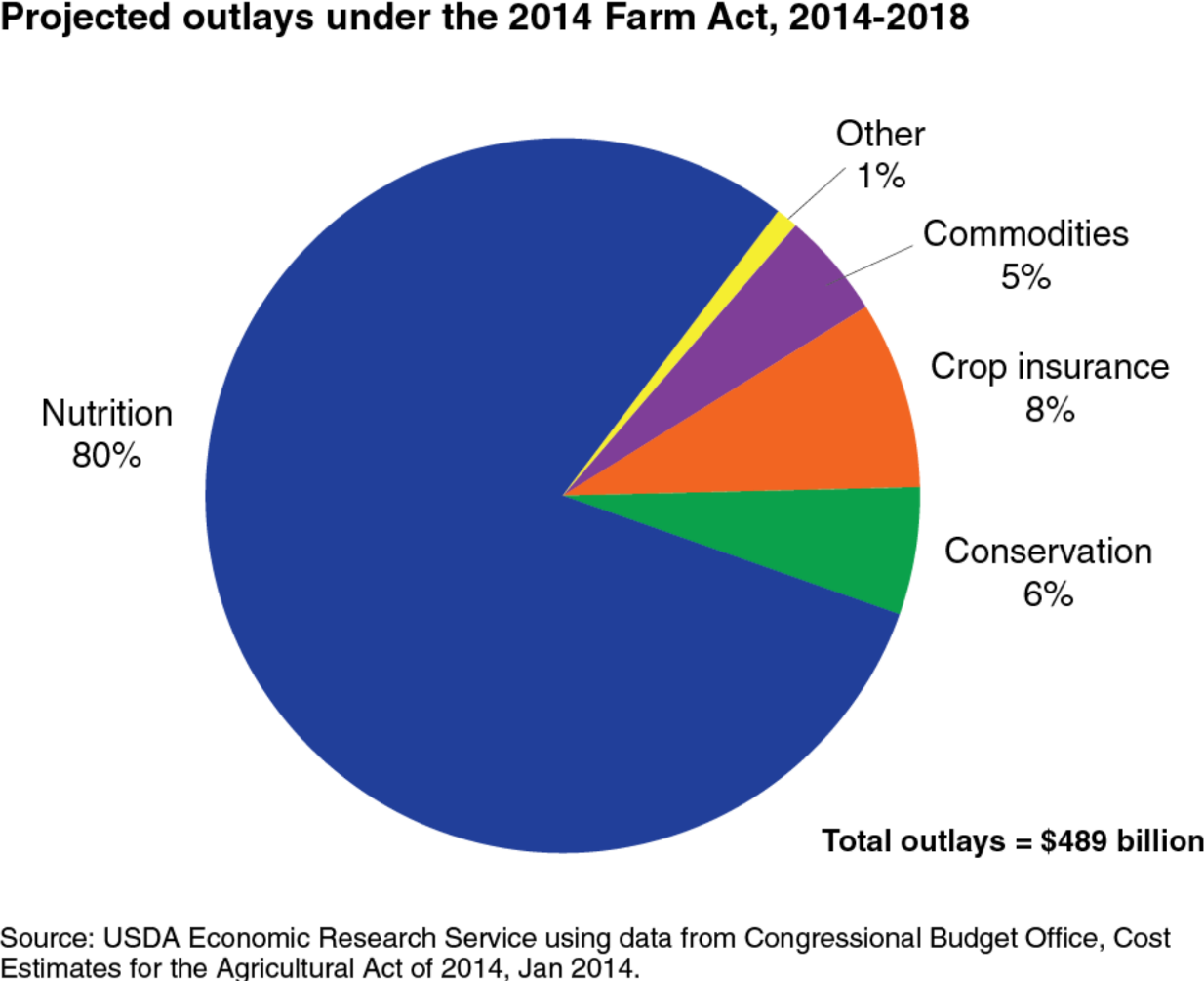

But when you look at the current breakdown of farm bill spending (see pie chart below), you can easily have a different perspective. It’s called a “farm bill” but most of the money goes to the Supplemental Nutrition Assistance Program, formerly known as food stamps.

But when you look at the current breakdown of farm bill spending (see pie chart below), you can easily have a different perspective. It’s called a “farm bill” but most of the money goes to the Supplemental Nutrition Assistance Program, formerly known as food stamps.

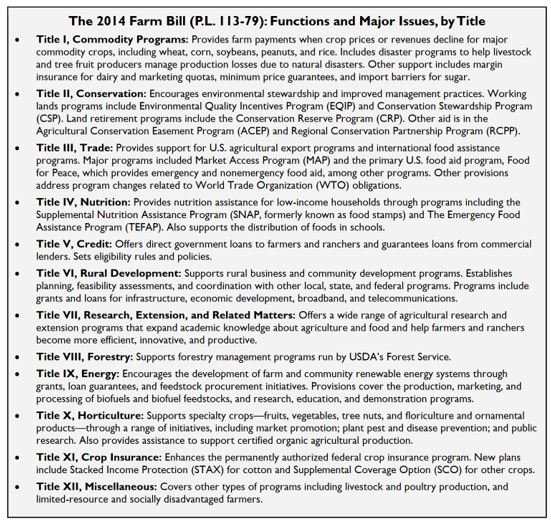

The 2014 farm bill actually has twelve titles. When the legislation was signed into law, the CBO projected that the total cost would be $489 billion over 5 years (2014-2018).

At that time, the nutrition section alone, which includes SNAP and several smaller domestic food aid programs, accounted for 80 percent of the spending. (It should be noted the farm bill does not authorize the two other major nutrition programs operated by USDA: school meals, and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). Those are authorized under a separate, child nutrition law.)

The sections of the bill that the public probably associates the most with farm bills are known in agriculture circles as the “farm safety net.” That’s the combination of the commodity title (Title I), which provides income and price support and marketing loans for grain, oilseed, cotton and dairy producers, and the crop insurance title (Title XI).

Projected outlays for crop insurance and commodities represented an additional 13 percent of the farm bill “pie” when the measure was first enacted.

The conservation title (Title II), which includes land-idling programs as well as “working lands” programs that subsidize the cost of farm practices and equipment that save soil or water and prevent pollution, roughly costs the same as the commodity title, or about 6 percent.

These four titles accounted for 99 percent of outlays: Nutrition, crop insurance, conservation and commodity supports, according to the Congressional Research Service.

If you’re following the math, that means the remaining titles in the farm bill – trade, credit, rural development, research, forestry, energy, horticulture and “miscellaneous” – share just 1 percent of total spending. But that 1 percent includes marketing and research spending critical to fruit and vegetable growers as well as the assistance to organic and local agricultural markets.

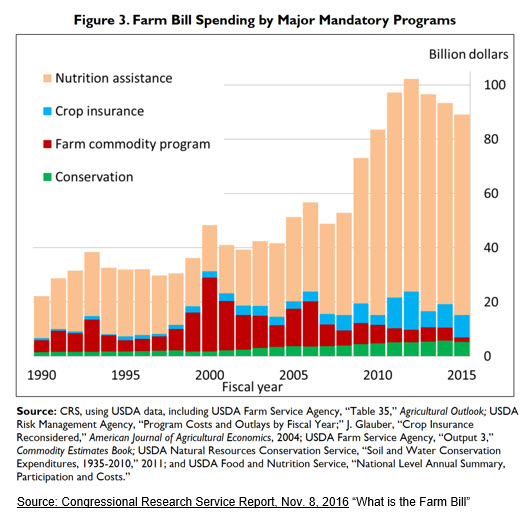

The share of farm bill spending that goes to SNAP and other nutrition programs has grown significantly since 2002, largely because program participation expanded sharply under the policies and economic conditions that existed during the presidencies of George W. Bush and Barack Obama.

When the 2002 farm bill was passed, it was estimated that nutrition programs would account for only 54 percent of the spending.

Baseline changes dramatically

When the farm bill was enacted in February of 2014, CBO projected that the 5-year total would be $489 billion, with $391 billion for nutrition and $98 billion for the agriculture portion.

But now, CBO’s new projections are much lower. That’s both good and bad news for those doing the farm bill math calculations.

On the nutrition front, the cost of SNAP has been falling sharply, in part because of the improving economy. CBO in January estimated that SNAP would cost $340 billion over the next five years, fiscal 2017 through 2021. That is $24 billion, or nearly $5 billion a year, less than CBO’s estimate a year ago for the same period, fiscal 2017-21. "This is making the case for safety net programs," for which costs fall as the need decreases, said the ranking Democrat on the Senate Agriculture Committee, Debbie Stabenow of Mich.

SNAP participation is expected to fall from 42.6 million this year to below 37 million by 2021.

Estimates for crop insurance spending have been lowered significantly, too, largely because of a change in CBO’s projected loss ratio for the program, says Pat Westhoff, who runs the Food and Agricultural Policy Research Institute at the University of Missouri.

For fiscal 2018, the program is now expected to cost taxpayers $7.2 billion. In January 2016, CBO estimated the fiscal 2018 cost at $8 billion. CBO’s new cost estimate for fiscal 2020 is $7.7 billion, which is $1 billion less than the FY20 estimate a year ago.

CBO previously assumed in its budget projections that indemnities each year would equal the premiums paid by farmers, plus the federal premium subsides. That is a loss ratio of 1.0. Now, the budget analysts are assuming a lower loss ratio of 0.91, meaning that losses will average less than the premiums and subsidies.

CBO previously assumed in its budget projections that indemnities each year would equal the premiums paid by farmers, plus the federal premium subsides. That is a loss ratio of 1.0. Now, the budget analysts are assuming a lower loss ratio of 0.91, meaning that losses will average less than the premiums and subsidies.

Westhoff says the new, lower loss-ratio estimate is “more consistent with actual history in the program.”

“That’s a very big deal and explains most of the difference in the estimates,” he says.

For 2016 crops, the loss ratio was a very modest 0.43. After farmers paid $3.5 billion in premiums, and the government provided $5.8 billion in premium subsides, insurance claims totaled just $3.9 billion. CBO had estimated in January 2016 that indemnities for that year would total $8.9 billion.

Going forward, the amount of money that the House and Senate Agriculture committees have to write the new law will be determined by the cost estimates that the Congressional Budget Office issues in March for the existing farm bill programs. CBO will once again project the cost, or “baseline,” for each title and program in the bill over the next 10 years. That March baseline then forms the pot of money that is likely to be available for the Agriculture committees to work with when they write the new farm bill.

Under congressional pay-as-you-go rules, creating a new program, or changing the rules of an existing program to increase its cost, will require the Agriculture committees to find an offset for that same amount – so as not to exceed the farm bill baseline.

It’s possible that the fiscal 2018 congressional budget resolution, assuming Congress agrees on one, could reduce the baseline by requiring a cut in farm bill spending. It’s also possible, theoretically at least, that a budget resolution could authorize an increase in spending. It’s happened before, though there is no sign thus far that it will happen this time.

A congressional source said it would also certainly require some heavy, unified political pressure from groups with a stake in the bill, as well as from the White House.

The last time there was a major downturn of the farm economy heading into a farm bill debate, in 2001, government payments to farmers totaled $22.4 billion when adjusted for inflation. That total includes $1.9 billion in conservation program benefits.

This year, USDA expects farm payments to total $12.4 billion, and that includes $3.3 billion in conservation benefits.

House Agriculture Chairman Mike Conaway, R-Texas, has not ruled out getting more money allocated for the farm bill. “We’ll see. We’re going to put our case out there,” he said.

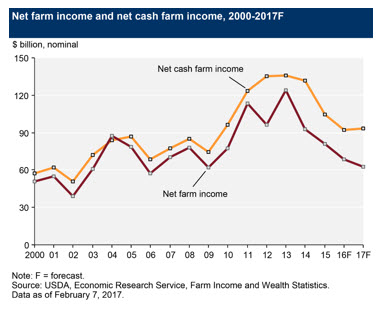

But he’s also arguing that the slump in the U.S. farm economy and recent reductions in cost estimates for the 2014 farm bill are making the case that farm programs should not be cut. After peaking in 2013, net farm income is projected to fall this year to its lowest level since 2002, when adjusted for inflation.

But he’s also arguing that the slump in the U.S. farm economy and recent reductions in cost estimates for the 2014 farm bill are making the case that farm programs should not be cut. After peaking in 2013, net farm income is projected to fall this year to its lowest level since 2002, when adjusted for inflation.

“We’re going to argue that further cuts are not warranted, further cuts are not appropriate in this arena. But I don’t get to make that decision by myself,” Conaway said.

It likely comes down to this: Lawmakers will probably be forced to eliminate or cut some programs in order to sweeten others or to create new ones.

But all that could change, if the Trump administration and Congress decide that the downturn in the farm economy justifies giving the Agriculture committees some more money.

It hasn’t always been this hard. In fact, lawmakers went into the last three farm bills knowing they had some extra sources of money in hand, either outside or within the bill, to address demands for new spending. Here are some examples:

The 2002 farm bill: Money to burn. When George W. Bush became president, the same year the 1996 Freedom to Farm law was set to expire, he and Congress seemed to have money to burn. In the 1990s, the combination of tax increases, economic growth and federal spending restraint had turned government deficits into annual surpluses.

Republican leaders were eager to spend down the surplus, and the Agriculture committees were happy to help. The new farm bill that was eventually enacted in May 2002 mandated $51.7 billion in additional spending over six years, beyond the March 2002 baseline. The new spending included $37.6 billion for commodity programs and $9.2 billion for conservation.

The 2008 farm bill: Democrats pony up. Going into the 2008 debate, it appeared that the Agriculture committees would be headed into a budget squeeze something like this year, when they turned to replace the 2002 farm bill. Increases in commodity prices in 2006 – as the demand for biofuels started to ramp up – and rising price projections in the following years, forced CBO to lower the baseline available to the Ag committees for the 2008 farm bill.

But Democrats took control of both the House and Senate in 2007 for the first time in 12 years and were looking to solidify their gains in rural House districts and farm states. One way to do that was to spend more money on farmers and rural development.

House Agriculture Chairman Collin Peterson, D-Minn.; Senate Budget Chairman Kent Conrad, D-N.D.; and Senate Finance Chairman Max Baucus, D-Mont., worked together to find additional money. The fiscal 2008 budget resolution, passed in 2007, earmarked a $20 billion reserve fund that authorized committees to find spending and revenue offsets for the farm bill.

House Agriculture Chairman Collin Peterson, D-Minn.; Senate Budget Chairman Kent Conrad, D-N.D.; and Senate Finance Chairman Max Baucus, D-Mont., worked together to find additional money. The fiscal 2008 budget resolution, passed in 2007, earmarked a $20 billion reserve fund that authorized committees to find spending and revenue offsets for the farm bill.

Ultimately, the 2008 farm bill provided $10 billion in additional spending over the projected baseline. The extra funding came from customs user fees, a change in estimated corporate tax payments and other provisions.

The 2014 farm bill: Direct payments pave the way. By 2011, as lawmakers turned to replacing the 2008 farm bill, the budget situation was very different. In the wake of the Tea Party rebellion, Republicans won control of the House in 2011 and forced President Obama to cut a deal on a landmark bill, the Budget Control Act, to rein in spending and cut the deficit.

The agreement created a “super-committee” to recommend a grand plan for reducing spending. If the super-committee couldn’t reach a deal, which it didn’t, the law called for 10 years of automatic spending cuts, known as sequestration.

Despite the super-committee’s failure, the leaders of the House and Senate Agriculture committees agreed on a plan to make $23 billion in farm bill cuts that were the super-committee’s target. Under the lawmakers’ plan, $15 billion would come out of commodity programs with the rest split between conservation programs and the Supplemental Nutrition Assistance Program.

The key to minimizing the impact of the cuts on commodity and conservation programs was that lawmakers had two big pots of money to work with: the roughly $5 billion in annual direct payments that the government had been providing to grain, oilseed and cotton growers since 1996, and the Conservation Reserve Program (CRP).

For some farmers, the direct payments had become an embarrassment when commodity prices skyrocketed, so eliminating them was politically advantageous. More importantly, it created a pot of money that could be used to create new, countercyclical programs that would be based on fluctuations in commodity prices or farm revenue.

At the same time, high commodity prices had created demand for shrinking the CRP as growers were eager to cultivate more land.

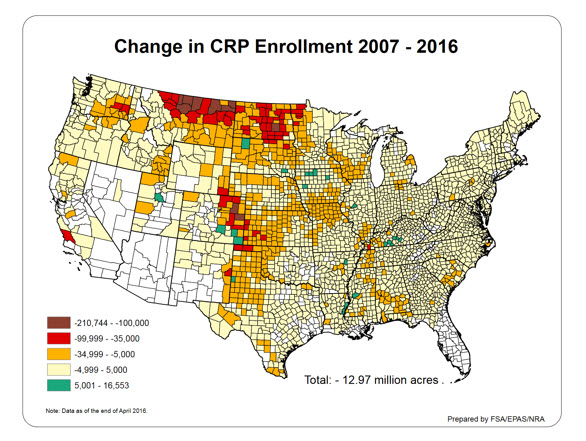

Program enrollment slid from a peak of almost 37 million acres in 2007 to 24 million acres in 2016 (See chart below.)

Savings from cutting CRP allowed lawmakers to bolster other conservation programs that subsidize new farming equipment and practices. (The cut came from gradually lowering the cap on CRP enrollment from 32 million to 24 million acres by fiscal 2018.)

What the farm bill gives, congressional appropriators can take away.

Farm bills contain both mandatory and discretionary spending.

Spending that is authorized, but not mandated, by a farm bill only gets spent if it gets included in the annual appropriations bills passed by Congress.

Appropriations committees have increasingly come to see some mandatory programs as sources of money they can put to other purposes, so spending is capped below the mandated level. Such cuts are known as Changes in Mandatory Program Spending, or ChIMPs.

From fiscal 2012 through 2016, Congress enacted $3.3 billion in ChIMPS on farm bill program spending. The Environmental Quality Incentives Program (EQIP) has accounted for $1.25 billion of those cuts, including a $350 million reduction in fiscal 2012.

The Watershed Rehabilitation Program was the second biggest loser through ChIMPS,with $620 million in cuts.

CHIMPS to programs such as EQIP have become so popular with appropriators over the past decade that the Agriculture committees now assume that the dollar amounts that they write into the farm bill for those programs will never be fully spent, a congressional aide said.

Congress has not yet acted on fiscal 2017 appropriations for most departments – the government is operating under a continuing resolution that maintains 2016 spending levels – but the House Agriculture Appropriations Subcommittee included another $427 million in farm bill CHIMPS to the 2017 spending bill the panel wrote for USDA.

Groups interested in conservation programs will be appealing to appropriators not to cut any of those programs, including EQIP and the Conservation Stewardship Program, in fiscal 2018 so that the cuts don’t result in lower spending levels in the next farm bill.

The sequestration cuts required by the 2011 Budget Control Act turned out to be a double whammy for the farm bill. Even though the 2014 farm bill cut spending, payments under most farm programs – other than SNAP and the CRP – also have been reduced through sequestration. In addition to reducing the baseline used to write the farm bill, additional sequestration cuts from fiscal 2013 through 2017 have reduced spending by another $6.4 billion, according to a congressional staff estimate.

The challenges ahead

Although commodity programs created by the 2014 farm bill are providing larger payments to farmers than were projected, the overall cost of the commodity title will start falling sharply because of the way one key program was designed, and that is going to provide a significant incentive for lawmakers to enact a farm bill in 2018, rather than waiting until 2019 or 2020. That’s because the lower costs lead to a shrinking baseline, potentially reducing the amount of money available to write the new farm bill the longer Congress waits.

The program in question – Agriculture Risk Coverage (ARC) – provides payments to growers when revenue falls below a five-year moving average. Commodity prices fell sharply after hitting highs in 2012, which led to large ARC payments during the first few years of the 2014 farm bill. But prices are now expected to stay at relatively low levels for the foreseeable future, and ARC payments will be declining dramatically as the higher prices in 2012 and 2013 disappear from the moving average.

ARC payments based on the program’s county-revenue option, by far the most popular one, are expected to peak at $5.9 billion in the current fiscal year, drop to $4.7 billion in fiscal 2018, $3.2 billion in 2019, $1.95 billion in 2020, and bottom out at $409 million by 2023. (There is a time lag between when a crop is grown and when growers receive their government payment. Payments made in fiscal 2017 are for crops produced in 2015. Payments for 2016 will go out this fall after the beginning of the 2018 fiscal year.)

The cost of a second program, Price Loss Coverage (PLC), will be rising significantly, because many farmers are expected to switch from ARC. But the increase won’t make up for the decline in ARC payments. PLC provides payments when the price for an eligible commodity falls below a target level, or reference price, in any given year. PLC payments are expected to rise from $1.8 billion this year to as much as $4.9 billion by 2021.

The bottom line: Even with that increase in PLC costs, total outlays for commodity programs are expected to peak at $9.6 billion in fiscal 2019 and fall to $5.4 billion by 2022, as the baseline shrinks.

Where’s the demand for more?

Cotton growers: Many lawmakers have even bigger reasons to finish a new farm bill during this Congress, and that is the pressure they’re feeling from cotton growers as well as growers who believe they have been shortchanged under the ARC program.

Cotton has virtually no baseline at all in the commodity title because growers aren’t eligible for ARC or PLC. The only payments they receive are through a marketing loan program that provides benefits when market prices are below the loan rate, which is lower than the PLC reference price.

Following Brazil’s successful World Trade Organization (WTO) case that challenged the legality of the price supports which cotton growers previously received, the industry agreed to creation of a revenue insurance program, the Stacked Income Protection Plan, better known as STAX, in lieu of participating in either ARC and PLC.

Growers quickly came to regret the decision. Cotton prices fell to and stayed at a level where there was little prospect of payments under STAX, so STAX is only being purchased on about one quarter of cotton acreage.

Growers then asked USDA to make cotton seed eligible for PLC using the reference price of $403 a ton for “other oilseeds” in the 2014 farm bill. However, the payments would have been huge, given that the market price for cotton seeds is about half that target rate. Agriculture Secretary Tom Vilsack declined the request anyway, saying he lacked the statutory authority.

Vilsack’s decision was a blow to the industry, not just because growers didn’t get the additional subsidies, but because the payments would have created a baseline for growers in the new farm bill. There would have been no need for them to ask for new assistance, and no need for lawmakers to find another source of money.

The industry hasn’t given up. Last year, the National Cotton Council developed a new legislative proposal that it hoped would be included in a year-end appropriations bill, which ultimately never materialized. The proposal would have created a specific reference price for cotton seed, closer to $300 a ton, and much of the cost would have offset – in part – by making growers ineligible for STAX if they wanted PLC coverage. The industry still hopes to include the measure in a spending measure Congress must pass in April to fund the remainder of the current fiscal year, but recent  market changes mean it will be more expensive than it would have been last year.

market changes mean it will be more expensive than it would have been last year.

Regardless of what happens this spring, the House Agriculture Committee chairman has assured growers their plan will make it into the farm bill. Conaway’s west Texas districts includes a portion of the vast cotton-growing region around Lubbock.

“Whatever I can do in the next two years to make that happen I’m going to do that. … Cotton will be the biggest change to the new farm bill,” he told members of the National Cotton Council.

Dairy farms. Milk producers say the Margin Protection Program created in the 2014 farm bill to protect them against spikes in feed prices – like the one that slammed the industry in 2009 – doesn’t provide the support they need. Most producers have opted for the minimum level of protection, available for the annual fee of $100, instead of buying up to higher levels of margin protection.

“We’re really good at producing milk but we need to have certainty in making sure that milk will be bought and paid a fair price going forward,” said Christopher Noble, co-owner of Noblehurst Farms in New York.

The problem dairy producers face heading into the next farm bill is that they have a very small baseline available because user fees were designed to cover all or some of the program’s cost. Expanding the program without raising user fees will require finding money from other commodity programs or other areas of the farm bill.

“The net cost of that program is not zero but it’s not far from zero. It’s tough to have a program for an industry that size that only costs” a few million dollars a year, said FAPRI director Westhoff. “How do you do something that farmers are going to find exciting if you don’t have any money to spend?

“The net cost of that program is not zero but it’s not far from zero. It’s tough to have a program for an industry that size that only costs” a few million dollars a year, said FAPRI director Westhoff. “How do you do something that farmers are going to find exciting if you don’t have any money to spend?

“It’s not obvious to me how you’re going to be able to do a lot for dairy without spending more taxpayer dollars than you are today.”

Some industry advocates want Congress to expand an insurance program available to dairy producers, Livestock Gross Margin Insurance Plan for Dairy Cattle (LGM-Dairy). As with crop insurance, the premiums are subsidized by taxpayers. However, the Federal Crop Insurance Act limits funding for the program to $20 million a year. Expanding the program would likely require lifting that cap, which would in turn encourage private companies to develop new LGM products, says John Newton, an economist for the Farm Bureau.

ARC. Some corn and soybean growers believe they are getting shortchanged under the current system relative to farmers in neighboring counties. A provision in the Senate’s fiscal 2017 USDA spending bill would set up an alternative way of calculating ARC payments, based on yields in contiguous counties.

But changing the calculations will require more money, and CBO projects most farmers who are now enrolled in ARC – 80 percent of corn acreage and 70 percent of soybean acreage – will switch to PLC under the next farm bill because of the better prospect for payments.

Economists say the disparities in county ARC payments largely result from natural differences in yields from one county to the next. But growers, particularly in North Dakota, believe they are also getting underpaid because of the county yield estimates that USDA uses for its revenue calculations when it has inadequate survey data.

There also are concerns with the program’s requirement for calculating county revenue guarantees using a five-year Olympic average of yields. (An Olympic average excludes the highest and lowest yields during the five-year period.)

“The problem is multiple-year yield losses will generate a low ARC revenue guarantee,” said Art Barnaby, a Kansas State University economist.

An analysis by Newton and Jonathan Coppess, a former administrator of USDA’s Farm Service Agency who’s now a professor at the University of Illinois, shows that allowing the revenue guarantee to be based on a 10-year average, rather than five, would have increased the 2014 ARC payments for corn, soybeans and wheat by 13 percent, or $448 million.

Sen. John Hoeven, a North Dakota Republican who is a member of the Senate Agriculture Committee and chairman of the Agriculture Appropriations Subcommittee, says the future of ARC will depend in large part in what lawmakers hear from farmers in coming months. He has supported offering farmers both ARC and PLC but he didn't rule out leaving ARC behind. "We want the best countercyclical safety net. I like the idea of options, but we’ll see what makes sense," he said.

Conservation. There is pressure to reverse some of the drop in CRP enrollment that the 2014 farm bill required as a budget-saving measure. The ranking member of the House Agriculture Committee, Collin Peterson of Minnesota, has recently called for raising the CRP cap from 24 million acres all the way up to 40 million acres, which would cost billions of dollars. Every million-acre increase in the CRP limit would cost $300 million to $400 million, conservation groups have been told.

Some conservation groups also want to shore up the Agricultural Conservation Easement Program (ACEP), which is used to purchase long-term easements for protection of wetlands, grasslands and other sensitive acreage.

Spending on ACEP is expected to peak in the current fiscal year at about $450 million and then drop sharply in 2018. ACEP’s baseline for the next farm bill will only be about $250 million.

Front-loading the ACEP spending in the first five years reduced the 10-year cost estimate and made it easier to fit into the spending targets lawmakers were working with when they wrote the 2014 bill.

A much smaller farm bill provision popular with beginning farmers has no baseline beyond the farm bill – the CRP Transition Incentives Program. (CRP-TIP). The program offers farmers and landowners with expiring CRP contracts two additional annual payments if they sell or rent the land to a beginning farmer or rancher, a veteran, or someone classified as “socially disadvantaged.” The 2014 farm bill provided the program with $33 million to be spent over five years.

Mandated spending levels for two other popular programs that subsidize farm practices and equipment, the Environmental Quality Incentives Program (EQIP) and Conservation Stewardship Program (CSP), have been reduced since the 2014 bill passed by appropriators.

Nutrition. Democrats would like to increase SNAP benefits, but with Republicans in control of the White House and Congress, that is unlikely to happen. Rep. Alma Adams, D-N.C., proposed a Closing the Meals Gap Act that would change the food spending benchmark used for calculating SNAP benefits from USDA’s Thrifty Food Plan to the somewhat higher priced Low-Cost Food Plan.

Some lawmakers may look for savings by restricting the types of foods and beverages that can be purchased with SNAP benefits.

A USDA study released in November found that SNAP recipients spent about 20 cents of every dollar on sweetened drinks, desserts, salty snacks and candy. Some conservatives say the finding justifies putting limits on SNAP purchases.

A USDA study released in November found that SNAP recipients spent about 20 cents of every dollar on sweetened drinks, desserts, salty snacks and candy. Some conservatives say the finding justifies putting limits on SNAP purchases.

However, only a small portion of the House Agriculture Committee expressed interest in the idea during a hearing earlier this week.

House Agriculture Chairman Mike Conaway, R-Texas, has been guarded on the issue. He issued a statement after the hearing that simply reflected the division of opinion: “While there is a case to be made for encouraging recipients to make healthy purchasing decisions, there are also concerns worth noting when it comes to restricting certain food and beverage options.”

The committee’s ranking Democrat, Collin Peterson of Minnesota, said that imposing restrictions on SNAP would “open a real can of worms. Grocery stores have no interest being the food police, and USDA has been resistant to that effort as well,” Peterson said.

Non-traditional agriculture and small programs. Some Democrats, including Debbie Stabenow, the ranking Democrat on the Senate Agriculture Committee, and Rep. Chellie Pingree, an organic farmer from Maine, want to provide financial assistance to agricultural interests who don’t represent traditional, large-scale agriculture, including urban farming projects, local, small-scale producers, farmers markets and organic farms.

Stabenow sees a political benefit to broadening the benefits fo the bill. "Anything that we can do that builds a coalition and brings people in to understand the importance of food policy and the food economy will help us pass the farm bill," she said.

Those initiatives are vital to attracting some Democratic votes, but the amounts are likely to be modest. But there’s a hitch: Several of these programs have little or no baseline. Lawmakers reduced CBO’s 10-year cost estimate, or “score,” for the programs by providing most or all of the funding in the first five years.

Keeping your eye on farm bill news? We’re covering it and lots of other ag and rural policy news. You won’t miss a beat if you sign up today for a four-week free trial Agri-Pulse subscription.

According to the Congressional Research Service, there are 37 programs in all that will lack baseline beyond the current farm bill. The 2014 farm bill provided $2.6 billion to those 37 programs over five years, or 0.5 percent of the law’s total spending, according to CRS. The energy and nutrition titles each have seven programs without baseline after fiscal 2018. The conservation and miscellaneous sections each have five.

Not all of the 37 programs were intended to be permanent. The Foundation for Food and Agriculture Research, is something of an anomaly. FFAR was established with $200 million in what was intended to be one-time seed money. Another $200 million was earmarked in the bill for a series of pilot projects testing various methods of helping SNAP recipients find jobs or better-paying employment.

The other programs without baseline will need new funding if they are to continue include:

-Beginning Farmer and Rancher Development Program, which provides grants to colleges and extension services to train new producers. The 2014 farm bill gave the program $20 million a year through fiscal 2018.

-Organic Agriculture Research and Extension Initiative. It was also funded at $20 million a year through FY2018.

-Food Insecurity Nutrition Incentives Program, which funds projects to increase fruit and vegetable consumption among SNAP beneficiaries. The program was provided $100 million over five years in varying amounts each year.

-Value Added Producer Grants Program, which provides grants for processing and marketing agricultural products. It was provided a total of $63 million.

-Rural Microentrepreneur Assistance Program, which provides small loans and grants to entrepreneurs who don’t benefit from traditional USDA assistance. It was funded at $3 million a year.

-Farmers Market and Local Food Promotion Program, which assists in development of farmers markets, roadside stands, community-supported agriculture (CSAs), agritourism and other projects. It was provided $150 million, or $30 million a year.

-National Organic Certification Cost Share Program, which subsidizes the cost of farmers who want to get certified as organic. The program was funded at $11.5 million a year through FY2018.

The seven energy programs without baseline beyond FY2018 include Biorefinery Assistance, which was provided with $200 million, and the Biomass Crop Asssistance Program, which was funded at $125 million. Funding for the energy title has been a top priority for Debbie Stabenow, the ranking Democrat on Senate Agriculture.

Where can lawmakers find additional money?

One way is for congressional leadership to put more money into the farm bill, as was done in 2002 and 2008. There is concern that the fiscal 2018 budget resolution could require a new round of cuts in farm programs, which would make writing the farm bill even more difficult.

Here are some other options for lawmakers. Most have significant political downsides because they could shift money from one group of stakeholders to another.

-Take care of cotton before the farm bill is written. Adding cotton seed to PLC legislatively or by an action of the new agriculture secretary would create a baseline for cotton before the Agriculture committees start writing the new farm bill.

Pros. This provides a funding stream without the need to take money from other programs.

Cons. Either the legislative or the administrative route will be difficult if the industry is required to offset the cost, especially given that the cost of the payments has gone up while the value of the potential offsets has fallen, under CBO’s new estimates.

-End the ARC program. There has been no public talk of doing this, but that hasn’t stopped ARC’s supporters from worrying that ARC could be in the cross hairs. The reason it’s even a possibility is because CBO analysts expect growers who are now enrolled in ARC to shift en masse to PLC if the next farm bill allows them to do so. That’s because ARC payments under the county revenue option (ARC-CO) are based on fluctuations from a five-year rolling average in county revenue. Once the high price years of 2012 and 2013 are gone from the average, ARC payments fall precipitously.

Pros: The savings could be used to fill the other demands for money, and most farmers are expected to switch from ARC-CO to PLC, if Congress allows them to, according to CBO.

Cons: ARC retains strong support from the corn and soybean sectors, who believe it provides a vital supplement to crop insurance when there are price spikes like the one caused by the 2012 drought. Killing the program also won’t save anything close to what the program paid out in its first years. ARC-CO payments will peak this year at $5.9 billion before plunging to just $409 million by fiscal 2021, assuming farmers do switch en masse to PLC under the next farm bill.

-Reducing PLC reference prices. That would reduce the cost of the program, and free up money that could be used to add cotton growers to the plan. Wheat, peanut and rice growers would presumably have the most to lose. PLC is expected to pay out $3.7 billion in fiscal 2018, with $1.6 billion of that going to wheat growers, $926 million to rice farms, and $544 million to peanut producers.

Pros: It is the biggest source of money in the commodity title.

Cons. It is expected to be the most popular commodity program in the new farm bill.

-Cut EQIP and CSP to fund conservation. Congressional appropriators certainly don’t have any problem dipping into the two programs on an annual basis through CHIMPS. Trimming one or the other, or both, could be used to shore up CRP and ACEP. Critics such as the Environmental Working Group have been particularly tough on CSP, saying the spending isn’t targeted sufficiently to major resource concerns such as water quality.

Pros. They are large pots of money.

Cons. Both programs enjoy wide support among farms of all sizes and descriptions. Plus, EQIP cost-share payments have benefitted livestock and fruit and vegetable operations that don’t participate in traditional commodity programs.

-Cut crop insurance. Former President Obama’s annual budgets provided several ways to reduce crop insurance. However, farm groups, banks and the crop insurance industry successfully fought to prevent the reductions from being enacted.

Still, crop insurance critics are likely to revisit changes. Farmers need to buy crop insurance out of their own pockets and have “skin in the game,” but the amount of premium paid is subsidized by about 62 percent nationally. Critics argue that premium subsidies could be reduced – especially for some of the nation’s largest growers. The supplemental revenue insurance products, STAX and the Supplemental Coverage Option, could also be eliminated but the savings would be small, since participation has been limited.

Another option that could save money is to reduce premium subsidies for revenue policies with the Harvest Price Option, which allows farmers to protect against upward movements in prices. President Obama’s fiscal 2017 budget proposed cutting the subsidy by 10 percentage points, which was projected to save $16.9 billion over 10 years. USDA officials argued that the cut would more closely track the value of the coverage.

The budget suggested saving another $1.1 billion over 10 years by restricting the purchase of prevented planting coverage. The proposal called for ending the option to purchase 5 or 10 percent higher protection than provided under base prevented planting coverage.

Pros: Some economists and critics of the program say farmers would still participate in and benefit from the program even if subsidies were reduced.

Cons: Farmers across the country consider crop insurance vital to their operations. If there’s one thing farm groups would be sure to unite around, it’s fighting any cuts to the program. During the last farm bill debate, they were joined by a wide variety of conservation and wildlife groups who argued that maintaining the crop insurance program was also vital to maintaining conservation on the ground. In part, that was because the 2014 farm bill relinked crop insurance to conservation compliance.

#30

To read the first part in our series, “The seven things you should know before you write the next farm bill,” go to “Lesson #1: Every farm bill is unique – the last one was a doozy.”

For more news, go to: www.Agri-Pulse.com