The renewable diesel boom has fueled a surge in expected soybean crushing capacity and a need for more production of the crop, though the Environmental Protection Agency's proposed Renewable Fuel Standard volumes and declining credit values for California’s Low Carbon Fuel Standard may dampen the fledgling industry’s ambitions.

Renewable diesel, a hydrocarbon, is chemically identical to petroleum and can be dropped into diesel engines without needing to be distilled or mixed. It can earn credits through the federal Renewable Fuel Standard Program and California’s Low Carbon Fuel Standard, as well as the federal Biodiesel Tax Credit Program, which was extended through 2024 under the Inflation Reduction Act.

But the main driver of the surge in expansion, economists agree, is California’s Low Carbon Fuel Standard. The program, administered by California’s Air Resources Board, sets annual carbon intensity standards for fuels used in the state. Renewable diesel producers can generate credits through the program.

“The RFS is important, but California's Low Carbon Fuel Standard is the driver for renewable diesel and it's big enough that it's causing these shifts away from biodiesel,” North Dakota State University economist David Ripplinger said.

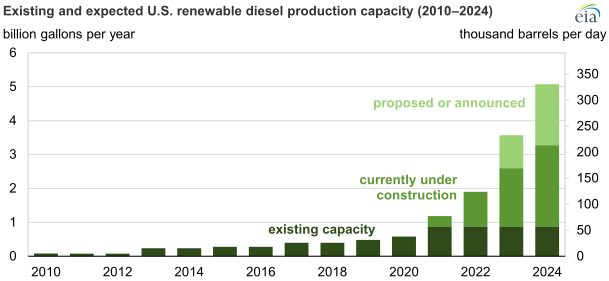

According to the Energy Information Administration, the U.S. can now produce at least 2 billion gallons of renewable diesel per year, which is more than double the 2020 production capacity of 600 million gallons.

Production capacity for renewable diesel is slated to increase even more by 2024. If all the previously announced projects were to be finished, the U.S. could have the ability to produce more than 5.1 billion gallons per year by that point, the EIA says.

These plants, if created, would require increases in soybean production and crush capacity. While other vegetable oils can be used, renewable diesel production is, at this point, largely reliant on soybean oil. While the EPA just approved an RFS pathway for using canola oil to produce renewable diesel, most plants aren’t equipped to use it.

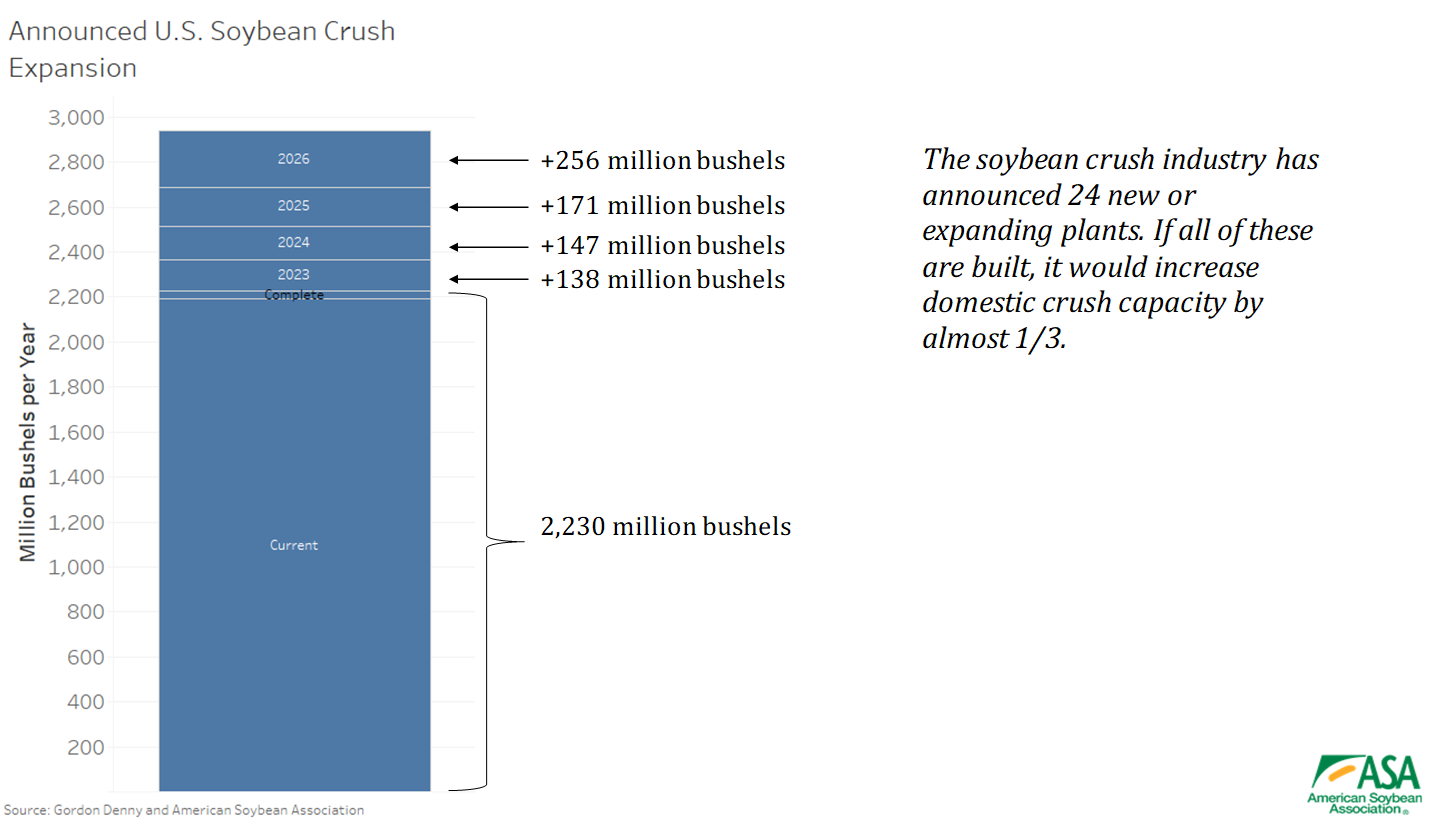

The 60 soybean crushing plants currently in operation in the U.S. can handle about 2.2 million bushels per year. American Soybean Association economist Scott Gerlt says there have been announcements for 24 new or expanded crush plants, which would altogether add around 712 million bushels per year in crush capacity.

According to a recent column by Gerlt, 13 of these announcements are for new plants and 10 are for the expansion of current plants. Two of the expansions have already been completed, Gerlt said.

Credit: Scott Gerlt, American Soybean Association

Credit: Scott Gerlt, American Soybean Association

The most recent plant announcement came in North Dakota on Monday when Epitome Energy announced its plans for a 42-million-bushel-per-year soybean crush plant in Grand Forks. The $400 million project is slated to be operational by fall 2025.

The increased demand for renewable diesel will require farmers to produce an additional 9.5 million to 10 million extra acres of soybeans by 2026, according to AgResource Co. economist Dan Basse. Because the U.S. already maximizes the use of its farmland, the surge in soy demand will likely mean more acres get planted on land put aside for other crops, like corn or wheat.

“Even if you take a little bit from everything, we need more acres in this country to produce what is coming,” Basse said.

Some of the expected renewable diesel refineries and crush plants, however, won’t get built, Gerlt said. The ones that do will be competing for a limited number of credits, particularly those issued under the RFS, which could lead to some of them closing.

The EPA's proposed RFS volumes for 2023, 2024 and 2025 relied on February projections of 1.5 billion gallons in production and did not include the plants that have come online since or that are slated for completion before the final rule comes out next year.

While the EPA could increase usage requirements in the final rule, Gerlt said renewable diesel producers and crush plant operators are concerned that the final targets will still “undercut” renewable diesel growth.

“There’s a lot more capacity now, but there’s almost no growth in the RVO,” Gerlt said. “The crushers, their stock prices fell after the announcement and then the soybean farmers, all this comes down to our level and affects the soybean prices.”

Interested in more coverage and insights? Receive a free month of Agri-Pulse!

At the same time, the value of credits under California’s low carbon fuel standard has gone down, dampening refiners’ hopes for participating in the program.

The average price per credit for October was $106 per credit, a 63% decline since the beginning of the year. The average price for January was $167.

“I'm not saying there's no growth,” Gerlt said. “I still think we'll see some, but I'm not sure it's gonna be what we thought even a week ago.”

Ripplinger, the North Dakota State University economist, said the declines in prices for credits are “reminiscent” of the corn ethanol markets 20 years ago. He said the market is beginning to respond to the demand.

“There’s going to be these shifts,” Ripplinger said. “Prices will moderate.”

A future increase in renewable diesel production is concerning to food companies reliant on the same soy-based feedstocks needed for renewable diesel production. The EPA has said in previous rules that renewable diesel production could divert soy and other vegetable oils away from food uses, a concern expressed by both the American Bakers Association and the Pet Food Institute.

Source: Energy Information Administration (2021)

Source: Energy Information Administration (2021)

Dana Brooks, president and CEO of the Pet Food Institute, told Agri-Pulse it’s difficult for pet food producers to compete with the government incentives encouraging renewable diesel production. She said many ingredient prices have already doubled, and she is concerned that pet food producers will be pushed out of certain markets as their costs continue to increase.

“We have high standards for ingredients for pet food, so we expect quality and predictable quantity of an ingredient to go into pet food making,” she said. “If edible ingredients are diverted to renewable diesel, then we lose that predictability in the market and the price point that we need.”

For more news, go to www.Agri-Pulse.com.